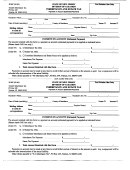

METHODS OF FILING

Four methods may be used to compute the Inheritance Tax on the New Jersey Non-Resident

Return. An election once made may not be changed and is irrevocable.

METHOD 1 – SIMPLIFIED TAX COMPUTATION

METHOD 2 - RATIO TAX USING NET ESTATE

METHOD 3 - RATIO TAX USING GROSS ESTATE

METHOD 4 - DIRECT TAX ON SPECIFIC DEVISE, JOINTLY OWNED

AND TRANSFERS OF NEW JERSEY REAL AND TANGIBLE PERSONAL PROPERTY

METHOD 1 – SIMPLIFIED TAX COMPUTATION

This is an optional method. It can be used instead of any of the above methods. Method 1 requires the

least amount of paperwork. Page 1 of the Inheritance Tax Return and the appropriate schedule are the

only items required to be completed. The tax is computed by multiplying the total of the New Jersey

assets by a 15% tax rate. Complete only the schedule which applies to the asset being reported and answer

the first 4 questions of Schedule “E”.

Use worksheet 1. See example on pages 14 and 16.

In the event all beneficiaries are Class “A” (see page 2 for a list of Class “A” beneficiaries) Form L9-NR

should be used as Class “A” beneficiaries are not subject to tax.

METHOD 2 - RATIO TAX USING NET ESTATE

This method requires that all of the decedent’s assets be reported on the various schedules. This includes

assets in New Jersey as well as those located in other states or countries. A deduction is permitted for all

qualified debts and expenses of the estate (see back of Schedule “C” for allowable deductions). A tax is

first computed on the entire net estate. The tax due New Jersey is then determined by multiplying the tax

so computed by a fraction the numerator of which is the adjusted value of the New Jersey property and

the denominator of which is the adjusted value of the entire net estate. This method requires that all of

the schedules be completed (Schedules A – F).

Use worksheet 2. See example on pages 14 and 17.

5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41