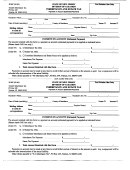

WORKSHEET 5

COMBINATION DIRECT TAX AND RATIO TAX USING NET ESTATE WORKSHEET

Decedent's Name

Decedent's SS NO

For use when there are two (2) or more New Jersey taxable assets and at least one of them is specifically

devised or jointly owned (joint tenants with right of survivorship), or transferred to one or more individuals within

three (3) years of the decedent's death, or to take effect at or after the decedent's date of death and the other

New Jersey taxable assets are held in the decedent's name alone or as tenants in common with another

individual.

If the New Jersey taxable property or any amount thereof is specifically devised or jointly owned (joint tenants

with right of survivorship), or transferred as indicated above, that amount is not subject to the ratio tax but rather

is taxed directly to the devisee(s) or surviving joint tenant(s) at the resident tax rates.

TAX COMPUTATION WORKSHEET

1. Direct tax on New Jersey taxable property specifically devised, jointly owned,

or transferred as indicated above. Use worksheet 4, page 11 to compute the tax

for this line…………………………………………………………………………...……..

1

2. Value of New Jersey taxable property not specifically devised, jointly owned, or

transferred as indicated above……………………………………………………...…..

2

3. Value of gross estate both in and outside of New Jersey (not including the New

Jersey property specifically devised, jointly owned, or transferred as indicated

above) (IT-NR, Page 1, Line 5 less New Jersey property described herein from

worksheet 4, line 4)…………………………………………………………………....…

3

4. Ratio (Line 2 divided by Line 3) ……………………………………………….…………

4

5. Total of administration expenses, counsel fees, and commissions

(from subtotal line in Schedule "C")………………………………………..…...….

5

6. Amount of Line 5 to be deducted from New Jersey taxable property not

specifically devised, jointly owned, or transferred as indicated above.

(Line 4 multiplied by Line 5) …………….……………………………………..…...….…

6

7. Net New Jersey property subject to the ratio tax (Line 2 minus Line 6) ……………..

7

8. Net estate wherever situate (not including the New Jersey property specifically

devised, jointly owned, or transferred as indicated above) (IT-NR, Page 1, Line 7,

less the New Jersey property described herein from worksheet 4, line 4)………….

8

9. Ratio (Line 7 divided by Line 8) (not to exceed 100%)……..……………………...….

9

10. New Jersey resident tax on amount reported on Line 8 above

(See page 2 of the instructions for classes of beneficiaries and tax rates) ………..

10

11. New Jersey Non-Resident Ratio tax (Line 9 multiplied by Line 10)…………………

11

12. Total New Jersey Non-Resident direct tax and ratio tax (Line 1 plus Line 11)

(Insert this amount on IT-NR page 1, Line 11)…………………………….………….

12

NOTE

In the event that any amount of the estate is contingent, the ratio calculated on Line 9 above should

be applied to the resident compromise tax to compute the nonresident compromise tax due.

All decimals are to be rounded to four places.

Page 12

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41