and pain and suffering are to be included in the decedent’s

any decedent composed of property, when such property was

estate.

received by the decedent before death.

b. Where an action is instituted under the New Jersey Death

9. The proceeds of any pension, annuity, retirement allowance,

Act and terminates through the settlement by a compromise

return of contributions or benefit payable by the Government of

payment without designating the amount to be paid under

the United States pursuant to the Civil Service Retirement Act,

each count, the amount which must be included in the

Retired Serviceman’s Family Protection Plan and the Survivor

inheritance tax return is an amount, to the extent recovered,

Benefit Plan to a beneficiary or beneficiaries other than the

which is equal to specific expenses related to the injury.

estate or the executor or administrator of a decedent are

These expenses are similar to those mentioned in section a.

exempt.

above and include funeral expenses, hospitalization and

10. All payments at death under the Teachers Pension and Annuity

medical expenses, and other expenses incident to the injury.

Fund, the Public Employees’ Retirement System for New

Any amount which is recovered in excess of these expenses

Jersey, and the Police and Firemen’s Retirement System of

is considered to be exempt from the tax.

New Jersey, and such other State, county and municipal

4. The proceeds of any contract of insurance insuring the life of a

systems as may have a tax exemption clause as broad as that of

resident or nonresident decedent paid or payable, by reason of

the three major State systems aforementioned, whether such

the death of such decedent, to one or more named beneficiaries

payments either before or after retirement are made on death to

other than the estate, executor or administrator of such

the employee’s estate or to his specifically designated

decedent are exempt for New Jersey Inheritance Tax purposes.

beneficiary, are exempt from the New Jersey Inheritance Tax.

5. The transfer of property to a beneficiary or beneficiaries of a

The benefit payable under the supplementary annuity plan of

trust created during the lifetime of a resident or nonresident

the State of New Jersey is not considered a benefit of the Public

decedent, to the extent such property results from the proceeds

Employee’s Retirement System and is taxable whether paid to

of any contract of insurance, insuring the life of such decedent

a designated beneficiary or to the estate.

and paid or payable to a trustee or trustees of such by reason of

The death benefits paid by the Social Security Administration

the death of such decedent, is exempt from the New Jersey

or railroad Retirement Board to the spouse of a decedent are

Inheritance Tax irrespective of whether such beneficiary or

also exempt. For purposes of filing a return these amounts need

beneficiaries have a present, future, vested, contingent or

not be reported nor are they to be deducted from the amount

defeasible interest in such trust.

claimed as a deduction for funeral expenses.

6.

The transfer of life insurance proceeds insuring the life of a

In all other cases the death benefit involved should either be

resident or nonresident decedent, paid or payable by reason of

reported as an asset of the estate or deducted from the amount

the death of such decedent to a trustee or trustees of a trust

claimed for funeral expenses.

created by such decedent during his lifetime for the benefit of

11. Other pensions. An exemption is provided for payments from

one or more beneficiaries irrespective of whether such

any pension, annuity, retirement allowance or return of

beneficiaries have a present, future, vested, contingent or

contributions, which is a direct result of the decedent’s

defeasible interest in such trust, is exempt from the New Jersey

employment under a qualified plan as defined by section

Inheritance Tax.

401(a), (b), and (c) or 2039(c) of the Internal Revenue Code,

7. The transfer, relinquishment, surrender or exercise at any time

which is payable to a surviving spouse or domestic partner.

or times by a resident or nonresident of this State, of any right

12. The amount payable by reason of medical expenses incurred as

to nominate or change the beneficiary or beneficiaries of any

a result of personal injury to the decedent should be reflected

contract of insurance insuring the life of such resident or

by reducing the amount claimed for medical expenses as a

nonresident, regardless of when such transfer, relinquishment,

result of the accident.

surrender or exercise of such right occurred, is exempt from the

tax.

The amount payable at the death of an income producer as a

result of injuries sustained in an accident, which are paid to the

8. Any amount recovered (under the Federal Liability for Injuries

estate of the income producer, is reportable for taxation. In all

to Employees Act) for injuries to a decedent by the personal

other instances this amount is exempt.

representative for the benefit of the classes of beneficiaries

designated in that Statute, whether for the pecuniary loss

The amount paid at death to any person under the essential

sustained by such beneficiaries as a result of the wrongful death

services benefits section is exempt from taxation.

of the decedent or for the loss and suffering by the decedent

The claim for funeral expense is to be reduced by the amount

while he lived, or both is not subject to the Inheritance Tax.

paid under the funeral expenses benefits section of the law.

Any amount recovered by the legal representatives of any

decedent by reason of any war risk insurance certificate or

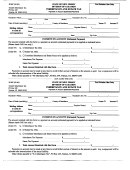

WHERE TO FILE

policy, either term or converted, or any adjusted service

All returns should be sent to: New Jersey Division of Taxation,

certificate issued by the United States, whether received

Inheritance and Estate Tax, PO Box 249, Trenton, New Jersey

directly from the United States or through any intervening

08695-0249.

estate or estates, is exempt from the New Jersey Inheritance

Tax.

This exemption does not entitle any person to a refund of any

tax heretofore paid on the transfer of property of the nature

aforementioned; and does not extend to that part of the estate of

3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41