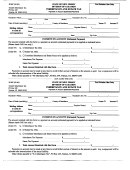

WORKSHEET 4

METHOD 4

DIRECT TAX WORKSHEET

Decedent's Name

Decedent's SS NO

This method is required to be used if the decedent either made a specific devise of New Jersey property,

or owned New Jersey property with another as Joint Tenants with the Right of Survivorship, or transferred

New Jersey property to another during the 3 year period prior to the decedent's date of death without

receiving the total (actual) fair market value of the property transferred, or where the decedent transferred

New Jersey real or tangible personal property but retained a right in the property for his/her lifetime. For a

more complete description of the above situations see those given on page 6 for Method 4.

IMPORTANT INSTRUCTIONS

1. If the decedent made a specific devise of New Jersey real estate complete Schedule "A". Only include

the New Jersey real estate. If there was a specific bequest of tangible personal property located in New

Jersey complete Schedule B(1). Only include the New Jersey tangible personal property.

2. If the decedent owned New Jersey real estate or New Jersey tangible personal property as Joint Tenants

with the Right of Survivorship complete Schedule A or Schedule B (1) or both, if both situations apply.

Only include New Jersey real estate or New Jersey tangible personal property. Do not include any other

assets.

3. If the decedent transferred New Jersey real estate or New Jersey tangible personal property during the 3

year period prior to his/her date of death without receiving the total (actual) fair market value of the

property or if the decedent transferred New Jersey real estate or tangible personal property but retained

a right in the property for his/her lifetime complete Schedule "E".

TAX COMPUTATION WORKSHEET

1

1. Enter total from Schedule A ……………………………………………………..….

2

2. Enter total from Schedule B (1) …………………………………………………….

3

3. Enter total from Schedule E …………………………………………………………

4

4. Total of above lines 1, 2 and 3………………………………………………………

5

5. New Jersey Resident Tax on amount reported on line 4.………………………….

(See page 2 of the instructions for classes of beneficiaries and tax rates)

6

6. New Jersey Non-Resident Inheritance Tax - Same as line 5……………………..

(Insert this number on IT-NR page 1, line 11).

Page 11

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41