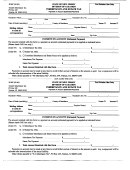

EXAMPLE 1 – USED FOR METHODS 1, 2 AND 3

The decedent died a resident of Pennsylvania owning real estate in Ocean City, New Jersey with a date of

death fair market value of $100,000.00 and an assessed value of $85,000.00. The decedent also owned a

boat, which was kept in New Jersey that had a value of $10,000.00.

Other assets consisted of real estate in Pennsylvania with a value of $200,000.00,

stock valued at $160,000.00, two bank accounts, one in Pennsylvania with a date of death balance of

$10,000.00 and one in New Jersey with a balance of $20,000.00. The total gross value of the estate

everywhere is $500,000.00.

The expenses of this estate are: attorney’s fees $3,000.00, executor’s commissions $2,000.00,

administration expenses $1,300.00, funeral expenses $6,000.00, credit card debt $8,000.00, telephone and

electric bills owed at death $230.00. Total expenses $20,530.00.

Gross Estate Everywhere

$500,000.00

Total Expenses Everywhere

20,530.00

Net Estate Everywhere

$479,470.00

Beneficiaries – The decedent’s niece is the only beneficiary.

EXAMPLE 2 – USED FOR METHOD 4 OR OPTIONAL METHOD 1

The decedent died a resident of Florida owning real estate in Florida worth $210,000.00 and bank

accounts with date of death balances totaling $105,000.00. Debts and administration expenses amounted

to $26,000.00.

The decedent also owned real estate, located in Cape May, New Jersey with a nephew as Joint Tenants

with the Right of Survivorship. The fair market value as of the decedent’s date of death was $160,000.00

and the assessed value was $132,000.00.

The New Jersey real estate was purchased in 1993. The decedent paid the full purchase price, the nephew

did not make any contributions towards purchasing the real estate. Therefore, the full $160,000.00 value

of the property will be used in the Inheritance Tax Return and on the tax computation worksheet.

As required by New Jersey Statute the full value of the New Jersey real estate must be used unless the

surviving joint tenant can prove to the satisfaction of the Director, Division of Taxation, State of New

Jersey that they contributed toward the purchase price.

The beneficiary of an asset owned as Joint Tenants with the Right of Survivorship is the surviving joint

tenant. In this particular matter the joint tenant is the decedent’s nephew, a Class “D” beneficiary.

Since the real estate was owned as Joint Tenants with the Right of Survivorship the estate is required to

use method 4 to compute the tax unless the optional method 1 is chosen.

Methods 1 and 4 use only the value of the New Jersey taxable assets in the tax computation. No other

assets are required to be reported or debts of the estate allowed to be claimed.

Page 14

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41