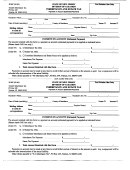

WORKSHEET 3

RATIO TAX USING GROSS ESTATE

METHOD 3

DIRECTIONS FOR COMPLETING THE INHERITANCE TAX RETURN USING THE INFORMATION GIVEN IN EXAMPLE 1 ON PAGE 14.

IT-NR - Page 1 Enter the total (gross) estate everywhere on IT-NR page 1, line 5 and line 9. (IMPORTANT)

Schedule A

Enter the description and values of only the New Jersey real estate

Schedule B

Do not complete this schedule.

Schedule B(1) Enter the description and value of only the boat located in New Jersey

Schedule C

Do not complete this schedule.

Schedule E

Answer the questions at the top of the schedule. If any are answered yes then complete the

bottom section. If assets are reported on this schedule then advise whether or not they are

included in the total (gross) estate everywhere figure reported on IT-NR page 1, line 5.

Schedule F

Enter the name and address of each beneficiary and complete each column

Directions for completing the worksheet using the numbers given in the example .

Line 1 Enter the total value of the New Jersey real estate ($100,000) and the boat (10,000) that

was kept in New Jersey.

Line 2 Enter the gross estate everywhere from IT-NR page 1, line 5.

Line 3 Divide line 1 by line 2 to get the ratio of the New Jersey taxable assets to the total (gross)

estate everywhere. All decimals are to be carried to 4 places. The ratio in this example is .2200.

Line 4 Enter the New Jersey Resident Tax on the total (gross) estate everywhere. Since the

beneficiary in this estate is a Class "D" beneficiary ( the tax rate for a Class "D" beneficiary

is 15%) the tax is computed by multiplying the gross estate by 15% ($500,000 x 15%). The

result is $75,000. This is the tax that would be due if the decedent was a resident of New Jersey

and all of his assets listed in the example were located in New Jersey.

Line 5 Multiply the amount of line 4 by the ratio on line 3. This gives you the New Jersey Non-Residen

Inheritance Tax. $16,500. Insert this number on IT-NR page 1, line 11.

WORKSHEET 3 - METHOD 3

RATIO TAX USING GROSS ESTATE

1 Gross value of New Jersey real estate & tangible personal property

1

110,000.00

[from Schedule "A" and/or "B(1)"]

2 Value of gross estate both in and outside of New Jersey

2

500,000.00

(from IT-NR page 1, line 5)

3 Gross to gross ratio (line 1 divided by line 2)

3

0.2200

4 New Jersey resident tax on amount reported on line 2 above

4

75,000.00

(see page 2 of the instructions for classes of beneficiaries and tax rates)

5 Ratio tax (line 3 multiplied by line 4)

5

16,500.00

(insert this number on IT-NR page 1, line 11)

All decimals are to be rounded to four places.

Page 18

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41