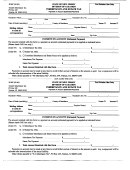

EXAMPLE 3 – USED FOR COMBINATION DIRECT TAX AND RATIO TAX OR

COMBINATION DIRECT TAX AND FLAT TAX OR OPTIONAL METHOD 1 WORKSHEETS

The decedent died a resident of New York owning real estate in New York worth $200,000.00, a bank

account with a date of death balance of $12,000.00 and stock valued at $8,000.00.

They also owned 2 parcels of real estate in New Jersey.

Parcel #1 was held in the decedent’s name alone. It was located in Florence, New Jersey and had a date

of death fair market value of $190,000.00 and an assessed value of $140,000.00.

Parcel #2 was held in the name of the decedent and a cousin as Joint Tenants with the Right of

Survivorship. It was located in Atlantic City and had a fair market value of $170,000.00 as of the date of

death and an assessed value of $151,000.00.

The jointly owned New Jersey real estate was purchased in 2002. The decedent paid the full purchase

price, the cousin did not make any contributions towards purchasing the real estate. Therefore, the full

$170,000.00 value of the property will be used in the Inheritance Tax Return and on the tax computation

worksheet.

As required by New Jersey Statute the full value of the New Jersey real estate must be used unless the

surviving joint tenant can prove to the satisfaction of the Director, Division of Taxation, State of New

1

Jersey that they contributed toward the purchase price.

The beneficiary of an asset owned as Joint Tenants with the Right of Survivorship is the surviving joint

tenant. In this particular matter the joint tenant is the decedent’s cousin, a Class “D” beneficiary.

The expenses of the estate are: attorney’s fees $5,000.00, executor’s commissions $4,000.00,

administration expenses $1,300.00, funeral expenses $6,000.00, credit card debt $8,000.00 and a

telephone bill of $100.00. Total expenses $24,400.00.

Gross estate everywhere

$580,000.00

Total expenses everywhere

24,400.00

Net estate everywhere

555,600.00

Beneficiaries –

The decedent’s cousin who is the joint tenant of parcel #2 inherits that parcel by right of survivorship.

The decedent’s niece inherits the remainder of the estate.

1

N.J.S.A. 54:34-1 f

Page 15

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41