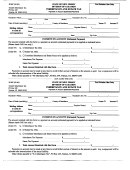

METHOD 3 - RATIO TAX USING GROSS ESTATE (FLAT TAX METHOD)

This method of filing is easier and quicker than Method 2 since it requires that only a total number be

given for the decedent’s assets wherever located. All assets do not need to be listed on the various

schedules as required under Method 2. Mortgage or liens due as of the decedent’s date of death are the

only allowable deductions. Only page 1 and Schedules A, E, F and sometimes B (1) are required to be

completed. Minimal information is reported on each. The tax computed using this method will in a large

number of instances approximate the tax computed under Method 2. THIS METHOD REQUIRES

THE ENTRY OF THE TOTAL ESTATE EVERYWHERE ON PAGE 1, LINES 5 AND 9

BEFORE COMPLETING THE WORKSHEET.

Use worksheet 3. See example on pages 14 and 18.

Note: The filing of a separate flat tax affidavit is not required since the requirements for filing

same are met by completing Page 1 and Schedules A,E,F and B(1) of Form IT-NR.

METHOD 4 - DIRECT TAX – SPECIFIC DEVISE, JOINTLY OWNED AND

TRANSFERS OF NEW JERSEY REAL AND TANGIBLE PERSONAL PROPERTY

This method must be used if any of the following situations apply:

A. When real estate or tangible personal property located in New Jersey is specifically devised by the

decedent’s Last Will and Testament or Trust Instrument. This includes the right to use the

property for life (life estate). A specific devise is a devise of specifically identified property such

as “my home at 4 Tioga Street, Maplewood, New Jersey”.

B. When the New Jersey real estate or tangible personal property is held or registered in the name of

the decedent and another individual as Joint Tenants with the Right of Survivorship.

C. When the real estate or tangible personal property located in New Jersey is transferred during the 3

year period prior to the decedent’s date of death and the decedent did not receive the total (actual)

fair market value of the property in money or money’s worth, or when the New Jersey real or

tangible personal property is transferred but the decedent retained a right in the property for

his/her lifetime.

Examples of tangible personal property are household furniture, automobiles, boats, artwork,

jewelry and other items located in New Jersey either permanently or for an indefinite period of

time.

This method only requires the filing of page 1 and Schedule A and F and sometimes Schedule B

(1) and E.

Use worksheet 4. See example on pages 14 and 19.

SEE PAGES 14 THRU 19 FOR EXAMPLES OF THE ABOVE METHODS.

6

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41