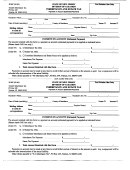

IMPORTANT REMINDERS

ITEMS TO SUBMIT WITH THE RETURN

A. If you are filing a return using Method 1, submit items 1, 2, and 6, 7 (if appropriate).

B. If you are filing a return using Method 4, submit items 1, 2, 3, 6 and 7 (if appropriate).

C. If you are filing a return using Method 2 or 3, submit all of the items listed.

D. If you have more than one New Jersey taxable asset and are filing a return using either

Method 4 or 1, submit items 1, 2, 3, 6 and 7 (if appropriate). If using a combination of

Methods 4 or 1 along with Methods 2 or 3, submit all of the items on the list.

1. If the decedent died testate you must submit a legible copy of the Last Will and Testament,

all codicils thereto and any separate writings.

2. Copy of the decedent’s death certificate.

3. Copies of all trust agreements created by the decedent.

4. Copy of the decedent’s last full year’s federal income tax return.

5. Copy of letters testamentary or of administration.

6. Copy of Form Hud-1 (closing statement) if the New Jersey real estate was sold after the

decedent’s death.

7. Copy of the deed to the New Jersey real estate, but only if the real estate was held in the

names of the decedent with others or transferred to another within 3 years prior to

decedent’s date of death.

PAYMENTS ON ACCOUNT

1. Payments on account may be made to avoid the accrual of interest. Form IT-EP is used for this

purpose. It may be found on Taxation’s website.

2. It is suggested that payments be made by certified check to avoid a possible delay in the issuance of

waivers.

3. All checks should be made payable to New Jersey Inheritance Tax and sent to New Jersey Division of

Taxation, Inheritance and Estate Tax, 50 Barrack Street, PO Box 249, Trenton, NJ, 08695-0249.

Note: All returns and forms must be signed, notarized and contain the decedent’s

social security number. All correspondence must contain the decedent’s name and

social security number.

7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41