LINE 20 and LINE 21, Family Size Tax Credit— The Family Size Tax Credit is based on modified gross income (MGI) and

the size of the family. If your total MGI is $30,657 or less, you may qualify for Kentucky Family Size Tax Credit.

S

o

—Determine your family size. Check the box on Line 20 to the right of the number that represents your family

tep

ne

size.

Family Size—Consists of yourself, your spouse if married and living in the same household and qualifying children.

Family Size 1 is an individual either single, or married living apart from his or her spouse for the entire year. You

may qualify for the Family Size Tax Credit even if you are claimed as a dependent on your parent’s tax return.

Family Size 2 is an individual with one qualifying child or a married couple.

Family Size 3 is an individual with two qualifying children or a married couple with one qualifying child.

Family Size 4 is an individual with three or more qualifying children or a married couple with two or more qualifying

children.

Qualifying Dependent Child—Means a qualifying child as defined in Internal Revenue Code Section 152(c), and includes a

child who lives in the household but cannot be claimed as a dependent if the provisions of Internal Revenue Code Section

152(e)(2) and 152(e)(4) apply. In general, to be a taxpayer’s qualifying child, a person must satisfy four tests:

Relationship—Must be the taxpayer’s child or stepchild (whether by blood or adoption), foster child, sibling or

stepsibling, or a descendant of one of these.

Residence—Has the same principal residence as the taxpayer for more than half the tax year. A qualifying child is

determined without regard to the exception for children of divorced or separated parents.

Age—Must be under the age of 19 at the end of the tax year, or under the age of 24 if a full-time student for at least

five months of the year, or be permanently and totally disabled at any time during the year.

Support—Did not provide more than one-half of his/her own support for the year.

S

t

—Determine modified gross income.

tep

wo

FORM 740 WORKSHEET FOR COMPUTATION OF MODIFIED GROSS INCOME FOR FAMILY SIZE TAX CREDIT

(a) Enter your federal adjusted gross income from Line 5. If zero or less, enter zero ........................................................... (a) __________________

(b) If married filing separately on a combined return or married filing separate returns and living

in the same household, enter your spouse’s federal adjusted gross income. If zero or less, enter zero ........................ (b) __________________

(c) Enter tax-exempt interest from municipal bonds (non-Kentucky) ...................................................................................... (c) __________________

(d) Enter amount of lump-sum distributions not included in federal adjusted gross income (federal Form 4972).............. (d) __________________

(e) Enter total of Lines (a), (b), (c) and (d) .................................................................................................................................... (e) __________________

(f) Enter your Kentucky adjusted gross income from Line 9. If zero or less, enter zero ...................................................... (f) __________________

(g) If married filing separately on a combined return or married filing separate returns and living in the same

household, enter your spouse’s Kentucky adjusted gross income from Line 9. If zero or less, enter zero ................... (g) __________________

(h) Enter amount of lump-sum distributions not included in adjusted gross income (Kentucky Form 4972-K) ................... (h) __________________

(i) Enter total of Lines (f), (g) and (h) ........................................................................................................................................... (i) __________________

(j) Enter the greater of Line (e) or (i). This is your Modified Gross Income.

Use this amount to determine if you qualify for the Family Size Tax Credit ...................................................................... (j) __________________

S

t

—Use the Family Size Table to look up the percentage of credit and enter in the space provided on Line 21.

tep

hree

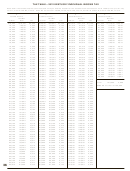

Family Size

One

Two

Three

Four or More

Credit

Percentage

If MGI . . .

is over

is not over

is over

is not over

is over

is not over

is over

is not over

is

$ ---

$ 11,170

$ ---

$15,130

$ ---

$19,090

$ ---

$23,050

100

11,170

11,617

15,130

15,735

19,090

19,854

23,050

23,972

90

11,617

12,064

15,735

16,340

19,854

20,617

23,972

24,894

80

12,064

12,510

16,340

16,946

20,617

21,381

24,894

25,816

70

12,510

12,957

16,946

17,551

21,381

22,144

25,816

26,738

60

12,957

13,404

17,551

18,156

22,144

22,908

26,738

27,660

50

13,404

13,851

18,156

18,761

22,908

23,672

27,660

28,582

40

13,851

14,186

18,761

19,215

23,672

24,244

28,582

29,274

30

14,186

14,521

19,215

19,669

24,244

24,817

29,274

29,965

20

14,521

14,856

19,669

20,123

24,817

25,390

29,965

30,657

10

14,856

---

20,123

---

25,390

---

30,657

---

0

S

F

—Multiply tax from Line 19 by the percentage and enter on Line 21. This is your Family Size Tax Credit.

tep

our

11

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76