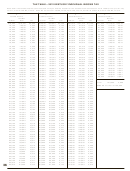

2012 FEDERAL/KENTUCKY INDIVIDUAL INCOME TAX DIFFERENCES

Kentucky income tax law is based on the federal income

The chart below provides a quick reference guide to the

tax law in effect on December 31, 2006. The Department of

major federal/Kentucky differences. It is not intended to be all

Revenue generally follows the administrative regulations and

inclusive. Items not listed may be referred to the Department

rulings of the Internal Revenue Service in those areas where

of Revenue to determine Kentucky tax treatment.

no specific Kentucky law exists.

FEDERAL

KENTUCKY

PROVISION

TAX TREATMENT

TAX TREATMENT

1. Interest from Federal Obligations

Taxable

Exempt

2. Retirement Income from:

Partially exempt if retired

after December 31, 1997;

Commonwealth of Kentucky Retirement Systems

Taxable

exempt if retired before

January 1, 1998;

Kentucky Local Government Retirement Systems

Taxable

Schedule P may be required

Federal and Military Retirement Systems

Taxable

3. Pensions and Annuities Starting After 7/1/86

3-year recovery rule eliminated

3-year recovery rule retained

and Before 1/1/90

4. Other Pension and Annuity Income

Taxable

100% excludable up to $41,110;

Schedule P may be required

5. Benefits from U.S. Railroad Retirement Board

May be taxable

Exempt; Schedule P may be

required

6. Social Security Benefits

May be taxable

Exempt

7. Capital Gains on Sale of Kentucky Turnpike Bonds

Taxable

Exempt

8. Other States’ Municipal Bond Interest Income

Exempt

Taxable

9. Kentucky Local Government Lease Interest Payments

Taxable

Exempt

10. Long-Term Care Insurance Premiums Paid With

Limited deduction as self-employed

100% adjustment to gross

After-Tax Dollars

health insurance

income

11. Medical and Dental Insurance Premiums Paid With

Limited deduction as self-employed

100% adjustment to gross

After-Tax Dollars

health insurance

income

12. Capital Gains on Property Taken by

Taxable

Exempt

Eminent Domain

13. Election Workers—Income for Training or

Taxable

Exempt

Working at Election Booths

14. Artistic Contributions

Noncash contribution allowed as

Appraised value allowed as

itemized deduction

itemized deduction or

adjustment to income

15. State Income Taxes

Deductible

Nondeductible

16. Leasehold Interest—Charitable Contribution

May be deductible

Deductible; Schedule HH

required

17. Kentucky Unemployment Tax Credit

No credit allowed

$100 per certified employee;

Schedule UTC required

18. Work Opportunity Credit (federal Form 5884)

Tax credit allowed; wage expense

No credit allowed; entire wage

reduced by amount of credit

expense is deductible

19. Welfare to Work Credit (federal Form 8861)

Tax credit allowed; wage expense

No credit allowed; wage expense

reduced by amount of credit

reduced by amount of federal

credit

20. Child and Dependent Care Credit

Tax credit based on expenses

20% of federal credit

21. Family Size Tax Credit

No credit allowed

Decreasing tax credit allowed

22. Education Tuition Tax Credit

Tax credit based on expenses

Credit allowed

Form 8863-K required

23. Taxpayer Who May be Claimed as Dependent

May not claim self

May claim self

on Another’s Return (i.e., full-time student)

24. Child’s Income Reported by Parent

Permitted; taxed at parent’s rate

Not permitted

25. National Tobacco Settlement TLAP Income

Taxable

Exempt

Quota Buyout (including imputed interest)

26. Bonus Depreciation/Additional Section 179 Expense

Deductible

Nondeductible

27. Mortgage Debt Forgiveness

Exempt

Taxable

28. Domestic Production Activities Deduction

Deductible

Deductible; may be limited

29. Active Duty Military Pay

Taxable

Exempt

30. Certain Business Expenses of Reservists

Deductible

Nondeductible

6

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76