Line 17—Enter artistic charitable contributions. A deduction

For more details, see federal Publication 547, Nonbusiness

is allowed for “qualified artistic charitable contributions” of

Disasters, Casualties, and Thefts. It also gives information

any literary, musical, artistic or scholarly composition, letter

about federal disaster area losses.

or memorandum, or similar property.

Lines 23 through 28—Miscellaneous Deductions

An amount equal to the fair market value of the property on

Most miscellaneous deductions cannot be deducted in full.

the date contributed is allowable as a deduction. However, the

You must subtract 2 percent of your adjusted gross income

deduction is limited to the amount of the taxpayer’s artistic

from the total. Compute the 2 percent limit on Line 27.

adjusted gross income for the taxable year.

Generally, the 2 percent limit applies to job-related expenses

you paid for which you were not reimbursed (Line 23). The

The following requirements for a deduction must be met:

limit also applies to certain expenses you paid to produce

(a) The property must have been created by the personal

or collect taxable income (Line 25). See the instructions for

efforts of the taxpayer at least one year prior to the

Lines 23 and 25 for examples of expenses to claim on these

date contributed. The creation of this property cannot

lines.

be related to the performance of duties while an officer

The 2 percent limit does not apply to certain oth-

or employee of the United States, any state or political

er miscellaneous expenses that you may deduct. These

subdivision thereof.

expenses can be deducted in full on Line 29. The Line 29

(b) A written appraisal of the fair market value of the

instructions describe these expenses. Included are deductible

contributed property must be made by a qualified

gambling losses (to the extent of winnings) and certain job

independent appraiser within one year of the date of the

expenses of disabled employees. See federal Publication 529,

contribution. A copy of the appraisal must be attached

Miscellaneous Deductions, for more information.

to the tax return.

Expenses You MAY NOT Deduct

(c) The contribution must be made to a qualified organiza-

tion as described in this section.

Political contributions.

Personal legal expenses.

Line 18—Enter any carryover of contributions that you were

Lost or misplaced cash or property (but see casualty and

not able to deduct in an earlier year because they exceeded

theft losses).

your adjusted gross income limit. See federal Publication 526

for details on how to figure your carryover.

Expenses for meals during regular or extra work hours.

The cost of entertaining friends.

Lines 20 through 22—Casualty and Theft Losses

Expenses of going to or from your regular workplace.

Line 20—Enter casualty or theft losses of property that is

Education needed to meet minimum requirements for

not trade, business, rent or royalty property. Attach federal

your job or that will qualify you for a new occupation.

Form 4684, Casualties and Thefts, or a similar statement to

Travel expenses for employment away from home if that

figure your loss.

period of employment exceeds one year.

Losses You MAY Deduct

Expenses of:

(a) Travel as a form of education.

You may be able to deduct all or part of each loss caused by

theft, vandalism, fire, storm, and car, boat and other accidents

(b) Attending a seminar, convention or similar meeting

or similar causes. You may also be able to deduct money you

unless it is related to your employment.

had in a financial institution but lost because of the insolvency

(c) Adopting a child, including a child with special

or bankruptcy of the institution.

needs.

Fines and penalties.

You may deduct nonbusiness casualty or theft losses only

Expenses of producing tax-exempt income.

to the extent that:

Amounts paid to organizations or establishments which

(a) the amount of each separate casualty or theft loss is more

have been found to practice discrimination.

than $100, and

(b) the total amount of all losses during the year is more

Expenses Subject to the 2 Percent Limit

than 10 percent of Line 9, Form 740.

Important: The increase in first-year luxury automobile

Special rules apply if you had both gains and losses from

depreciation caps, the 30 percent and the 50 percent special

nonbusiness casualties or thefts. See federal Form 4684 for

depreciation allowance, the additional New York Liberty

details.

Zone Section 179 deduction for property placed in service

Losses You MAY NOT Deduct

after September 10, 2001, and the increased Section 179

deduction limits and thresholds for property placed in service

Money or property misplaced or lost.

after December 31, 2002, are not allowable for Kentucky

Breakage of china, glassware, furniture and similar items

tax purposes. For passenger automobiles purchased

under normal conditions.

after September 10, 2001, you must compute Kentucky

Progressive damage to property (buildings, clothes,

depreciation in accordance with the IRC in effect on December

trees, etc.) caused by termites, moths, other insects or

31, 2001. Create a Kentucky Form 2106 by entering Kentucky

disease.

at the top center of a federal Form 2106, Employee Business

Deduct the costs of proving you had a property loss as a

Expenses. Complete Section D—Depreciation of Vehicles

miscellaneous deduction on Line 25, Schedule A. (Examples

in accordance with the IRC in effect on December 31, 2001.

of these costs are appraisal fees and photographs used to

Attach a copy of the federal Form 2106 filed for federal income

establish the amount of your loss.)

tax purposes if no adjustments are required.

26

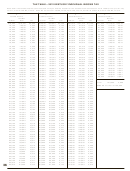

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76