credits for dependents, or one spouse may claim all depen-

SECTION B—PERSONAL TAX CREDITS

dent credits and the other none.

Line 1(a), Yourself—You are always allowed to claim a tax

Example I—A husband who is 65 and a wife who is 60 are

credit for yourself (even if your parent(s) can claim a credit

filing separately on a combined return. The husband must

for you on their return). On Line 1(a), there are five boxes

claim three credits (one regular and two for being 65 or older),

under three separate headings. Always check the box under

and the wife must claim one.

“Check Regular” to claim a tax credit for yourself. If 65 or

Example II—A husband and wife have two dependents. The

older, also check the next two boxes on the line. If legally

blind, also check the last two boxes on the line.

husband must claim his regular credit, and the wife must

claim hers. However, the two dependent credits may be

Line 1(b), Your Spouse—Do not fill in Line 1(b) if (1) you are

claimed by either spouse, or each spouse may claim one.

single; (2) you are married and you and your spouse are filing

For married taxpayers, each spouse must claim all of his or

two separate returns; or (3) your spouse received more than

half of his or her support from another taxpayer.

her own credits. Therefore, each spouse must claim at least

one credit. Credits for dependents may be divided between

Fill in Line 1(b) if you are married and (1) you and your

the spouses, or one spouse may claim all the credits for

spouse are filing a joint or combined return, or (2) if your

dependents and the other none.

spouse had no income or is not required to file a return. If

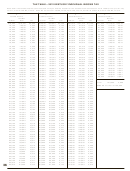

TIP—Multiply credits by $20 and subtract from

you meet these criteria, check the first box on Line 1(b) for

tax on page 1. The tax table and the tax rate

your spouse. If your spouse is 65 or older, also check the next

schedule do not deduct for tax credits.

two boxes. If your spouse was legally blind at the end of the

taxable year, also check the last two boxes on Line 1(b).

Remember to carry amounts from page 3,

Line 4A and/or 4B, to page 1, Line 17.

Dependents—You are allowed to claim a tax credit for each

person defined as a dependent in the Internal Revenue Code.

Generally, dependents who qualify for federal purposes also

SECTION C—FAMILY SIZE TAX CREDIT

qualify for Kentucky.

Children may only be counted for family size by the custodial

Line 2, Dependents Who Live With You

parent. Even if you have signed federal Form 8332 and may

not claim the child as a dependent, you may count children

Use to claim tax credits for your dependent children, including

who otherwise meet the requirements for the Family Size

stepchildren and legally adopted children, who lived with

Tax Credit.

you during the taxable year. If the dependent meets the

requirements for a qualifying child under the provisions of

You must include in Section C the names and Social Security

IRC 152(c), check the box; this child qualifies to be counted

numbers of the qualifying children that are not claimed as

to determine the family size.

dependents in Section B in order to count them in your total

family size.

Dependents Who Did Not Live With You

Also use Line 2 to claim tax credits for your dependent

children who did not live with you and to claim tax credits for

COPY OF FEDERAL RETURN

other persons who qualify as dependents. These dependents

do not qualify to be counted to determine the family size.

You must attach a complete copy of your federal return if you

received farm, business, or rental income or loss.

Children of Divorced or Separated Parents—Attach a copy of

federal Form 8332 filed with your federal return. Children may

The Kentucky Department of Revenue does not require copies

only be counted for family size by the custodial parent.

if you filed Form 1040EZ or 1040A. Check the box on Form

740, page 3 if you are not required to attach a copy of your

Tax Credits for Individuals Supported by More Than One

federal return.

Taxpayer—Attach a copy of federal Form 2120 filed with your

federal return.

SIGN RETURN

Kentucky National Guard Members—Persons who were

members of the Kentucky National Guard on December 31,

Be sure to sign on page 3 after completion of pages 1, 2 and

2012, may claim an additional credit on Line 2. Designate

3 of your return. Each return must be signed by the taxpayer.

this credit with the initials “N.G.” Kentucky law specifically

Joint and combined returns must be signed by both husband

restricts this credit to Kentucky National Guard members;

and wife. Returns that are not signed may be returned to you

military reserve members are not eligible.

for signature.

Lines 3A and 3B, Dividing the Credits—Each taxpayer must

Please enter a telephone number where you can be reached

claim all of his or her own tax credits including the credits for

during regular working hours. You may be contacted for

age and blindness. Therefore, if married, each spouse must

additional information needed to complete processing your

claim at least one credit. However, spouses may divide tax

tax return.

19

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76