on each spouse’s income. The indebted

If a combined return was filed, the

Persons who do not prepay at least 70

spouse’s refund will then be paid to the

percent of the tax liability may be subject

exclusion would apply to the income

appropriate agency.

to a 10 percent penalty for underpayment

reported in Column A or Column B of

of estimated tax. If you are required to

the Kentucky return attributable to the

make estimated tax payments you may

military member. If a joint return was

Death of a Taxpayer

also be subject to interest if the payments

filed, the income must be separated

are not made timely. Prepayments for

accordingly. Refunds will be issued

2013 may be made through withholding,

If a taxpayer died before filing a return

in the names on the original return.

a credit forward of a 2012 overpayment

for 2012, the taxpayer’s spouse or

Beneficiaries or estates that received

or estimated tax installment payments.

personal representative may have to

death benefits that were included in a

The instructions for Form 740-ES include

file and sign a return for that taxpayer.

Kentucky return may file an amended

a worksheet for calculating the amount

A personal representative can be an

return to request a refund of taxes paid

of estimated tax due and for making

executor, administrator or anyone who

on the benefit.

installment payments. These forms

is in charge of the deceased taxpayer’s

may be obtained from the Kentucky

proper ty. If the deceased taxpayer

The Department of Revenue will use the

Department of Revenue, Frankfort,

did not have to file a return but had

Veterans Administration definition for

KY 40620, or any Kentucky Taxpayer

tax withheld, a return must be filed to

“in the line of duty,” which states that

Service Center. You may also download

get a refund. The person who files the

a soldier is in the line of duty when he

Form 740-ES and instructions at www.

return should enter “DECD” after the

is in active military service, whether on

revenue.ky.gov, the Department of

deceased taxpayer’s name and write

active duty or authorized leave; unless

Revenue’s Web site.

“DECEASED” and the date of death

the death was the result of the person’s

across the top of the return.

own willful misconduct.

If your spouse died in 2012 and you did

not remarry in 2012, you can file jointly

or separately on a combined return. The

Income Tax Withholding

return should show your spouse’s 2012

income before death and your income

for 2013

Return Adjustments

for all of 2012. You can also file jointly

or separately on a combined return if

If the amount you owe or the amount

If the Department of Revenue adjusts your

your spouse died in 2013 before filing

you overpaid is large, you may want

return and you do not understand the

a 2012 return. Write “Filing as surviving

to change the amount of income tax

adjustment, you may write to Taxpayer

spouse” in the area where you sign the

withheld from your 2013 pay. To do so

Assistance, Kentucky Department of

return. If someone else is the personal

you must file a new Form K-4 with your

Revenue, P.O. Box 181, Station 56,

representative, he or she must also

employer.

Frankfort, KY 40602-0181 or call (502) 564-

sign.

4581. If you disagree with an adjustment

The Family Size Tax Credit is based on

made to your return, you may appeal

modified gross income and the size of

that adjustment by submitting a written

the family. See instructions for Lines 20

Death of Military

protest within 45 days of notification.

and 21 for further explanation of these

Personnel Killed

limitations. Changes have been made

to the Special Withholding Exemption

in Line of Duty

Certificate (Form K-4E) to reflect the

Family Size Tax Credit. If you do not

KRS 141.010(10)(t) exempts all income

expect to have any tax liability for the

earned by soldiers killed in the line of

current year and you meet the modified

duty from Kentucky tax for the years

gross income requirements, you may

Amended Returns

during which the death occurred and the

be entitled to claim exemption from

year prior to the year during which the

withholding of Kentucky income tax.

death occurred.

The Special Withholding Exemption

If you discover that you omitted

C e r t i f i c a t e ( F o r m K - 4 E ) c a n b e

deductions or otherwise improperly

The exemption applies to tax years

downloaded at

prepared your return, you may obtain

beginning after December 31, 2001. The

business/whtax.htm, the Department of

a refund by filing an amended return

income exclusion applies to all income

Revenue’s Web site.

within four years of the due date of

from all sources of the decedent, not

the original return. You are required

just military income. The exclusion

to file an amended return to report

includes all federal and state death

omitted income. You may obtain

benefits payable to the estate or any

2013 Estimated Tax

Form 740-X by contacting a Kentucky

beneficiaries.

Payments

Taxpayer Service Center or writing

FORMS, Kentucky Department of

Amended returns may be filed for the

Revenue, Frankfort, KY 40620. You

year the soldier was killed in the line

Persons who reasonably expect to have

may also download Form 740-X at

of duty and the year prior to the year

income in excess of $5,000 from which

, the Department

of death. The amended returns must

no Kentucky income tax will be withheld

of Revenue’s Web site.

be filed within the statute of limitations

may be required to make estimated tax

period; four years from the due date, the

payments on Form 740-ES. However, if

extended due date or the date the tax

the amount of estimated tax is $500 or

was paid, whichever is later.

less, no estimated payments are required.

4

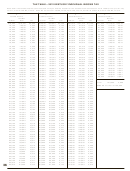

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76