of credit that may be claimed in any given year is limited

income tax imposed by KRS 141.020, KRS 141.040 or KRS

to 25 percent of the total amount certified by the Kentucky

141.0401 on the income of the approved company generated

Economic Development Finance Authority (KEDFA). For

by or arising out of a project as determined under KRS 154.48-

020. An “environmental stewardship product” means any new

investments after June 30, 2002, the credit is claimed on the

tax return filed for the tax year following the year in which the

manufactured product or substantially improved existing

manufactured product that has a lesser or reduced adverse

credit is granted and is limited in any tax year to 50 percent

of the initial aggregate credit apportioned to the investor.

effect on human health and the environment or provides for

Attach a copy of the certification by KEDFA in the first year

improvement to human health and the environment when

claimed. Any excess credit may be carried forward. No credit

compared with existing products or competing products that

may extend beyond 15 years of the initial certification.

serve the same purpose. A company must have eligible costs

of at least $5 million and within six months after the activation

Line 9, Coal Incentive Tax Credit—A company that owns and

date, the approved company compensates a minimum of 90

operates an alternative fuel facility or a gasification facility as

percent of its full-time employees whose jobs were created

defined in KRS 154.27-010 may be entitled to a coal incentive

or retained base hourly wages equal to either: (1) 75 percent

tax credit. Application for this credit is made on Schedule

of the average hourly wage for the Commonwealth; or (2) 75

CI, Application for Coal Incentive Tax Credit, and a copy of

percent of the average hourly wage for the county in which

the credit certificate issued by the Kentucky Department of

the project is to be undertaken. The maximum amount of

Revenue must be attached to the return on which the credit

negotiated inducement that can be claimed by a company for

is claimed.

any single tax year may be up to 25 percent of the authorized

inducement. The agreement shall expire on the earlier of

Line 10, Qualified Research Facility Tax Credit—A

the date the approved company has received inducements

nonrefundable credit is allowed against individual and

equal to the approved costs of its project, or 10 years from

corporation income taxes equal to 5 percent of the cost

the activation date. For more information, contact the Cabinet

of constructing and equipping new facilities or expanding

for Economic Development, Old Capitol Annex, 300 West

or remodeling existing facilities in Kentucky for qualified

Broadway, Frankfort, KY 40601.

research. “Qualified research” is defined to mean qualified

research as defined in Section 41 of the IRC. Any unused

KRS 141.430 was amended to provide that for tax years

credit may be carried forward 10 years. Complete and attach

beginning on or after June 4, 2010, the base tax year is

Schedule QR, Qualified Research Facility Tax Credit.

reduced by fifty percent (50%). The base tax year is the

combined income tax and LLET for the first taxable year

Line 11, Employer GED Incentive Tax Credit—KRS Chapter

after December 31, 2005, that ends immediately prior to

151B.127 provides a nonrefundable income tax credit for

the activation date. If the base year is for a taxable year

employers who assist employees in completing a learning

beginning before January 1, 2007, the LLET will not apply.

contract in which the employee agrees to obtain his or

her high school equivalency diploma. The employer shall

Caution: An approved company under the Environmental

complete the lower portion of the GED-Incentive Program

Stewardship Act shall not be entitled to the recycling credit

Final Report (Form DAEL-31) and attach a copy to the return

provided under the provisions of KRS 141.390 for equipment

to claim this credit. Shareholders and partners should

used in the production of an environmental stewardship

attach a copy of Schedule K-1 showing the amount of credit

project.

distributed. For information regarding the program, contact

Line 15, Clean Coal Incentive Tax Credit—A nonrefundable,

the Education Cabinet, Kentucky Adult Education, Council on

nontransferable credit against taxes imposed by KRS 136.120,

Postsecondary Education.

KRS 141.020, KRS 141.040 or KRS 141.0401 shall be allowed

Line 12, Voluntary Environmental Remediation Credit—This

for a clean coal facility. As provided by KRS 141.428, a clean

line should be completed only if the taxpayers have an

coal facility means an electric generation facility beginning

agreed order with the Environmental and Public Protection

commercial operation on or after January 1, 2005, at a cost

Cabinet under the provisions of KRS 224.01-518 and have

greater than $150 million that is located in the Commonwealth

been approved for the credit by the Department of Revenue.

of Kentucky and is certified by the Environmental and Public

Maximum credit allowed to be claimed per taxable year is 25

Protection Cabinet as reducing emissions of pollutants

percent of approved credit. For more information regarding

released during generation of electricity through the use

credit for voluntary environmental remediation property,

of clean coal equipment and technologies. The amount of

contact the Environmental and Public Protection Cabinet at

the credit shall be two dollars ($2) per ton of eligible coal

(502) 564-3350. To claim this credit, Schedule VERB must be

purchased that is used to generate electric power at a certified

attached.

clean coal facility, except that no credit shall be allowed if the

eligible coal has been used to generate a credit under KRS

Line 13, Biodiesel and Renewable Diesel Credit—Producers

141.0405 for the taxpayer, parent or a subsidiary.

and blenders of biodiesel and producers of renewable diesel

are entitled to a tax credit against the taxes imposed by KRS

Line 16, Ethanol Tax Credit—An ethanol producer shall be

141.020, KRS 141.040 and KRS 141.0401. The taxpayer must

eligible for a nonrefundable tax credit against the taxes

file a claim for biodiesel and renewable diesel credit with the

imposed by KRS 141.020 or 141.040 and 141.0401 in an amount

Department of Revenue by January 15 each year for biodiesel

certified by the department. The credit rate shall be one dollar

produced or blended and the renewable diesel produced in

($1) per ethanol gallon produced, unless the total amount

the previous calendar year. The department shall issue a credit

of approved credit for all ethanol producers exceeds the

certification to the taxpayer by April 15. The credit certification

annual ethanol tax credit cap. If the total amount of approved

must be attached to the tax return claiming this credit.

credit for all ethanol producers exceeds the annual ethanol

tax credit cap, the department shall determine the amount

Line 14, Environmental Stewardship Tax Credit—An approved

of credit each ethanol producer receives by multiplying the

company may be permitted a credit against the Kentucky

17

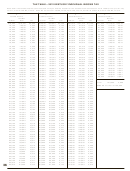

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76