LINE 23, Education Tuition Tax Credit—Complete Form 8863–K

If you do not meet the filing requirements to file a federal

to claim this credit. See form and instructions.

income tax return but would have been entitled to the fed-

eral child and dependent care credit, you may claim the child

and dependent care credit for Kentucky purposes. Complete

LINE 25, Child and Dependent Care Credit—Enter in the

space provided the amount of credit calculated on federal

and attach federal Form 2441, state on the form “did not

meet federal filing requirements” and follow instructions

Form 2441, Line 9, for child and dependent care expenses.

Multiply this amount by 20 percent (.20), and enter result

for Line 25.

on Line 25.

LINE 27, Kentucky Use Tax

Important Reminder from the Department of Revenue About Out-of-State Purchases:

If you made untaxed purchases from out-of-state retailers, the use tax line on your return should contain a number.

Like every other state that has a sales tax, Kentucky has a use tax that requires that out-of-state purchases of tangible personal property or

digital property for use in Kentucky be taxed at the same amount as if they had taken place in Kentucky and subjected to Kentucky’s sales tax.

This ensures equality of treatment between in-state and out-of-state transactions. Although the use tax has been in the tax code since 1960, it

is now more relevant than ever because of the increasing percentage of online sales. Pursuant to KRS 139.330, a 6 percent use tax is due if you

make out–of–state purchases for storage, use or other consumption in Kentucky and did not pay at least 6 percent state sales tax to the seller at

the time of purchase. For example, if you order from catalogs, make purchases through the Internet, or shop outside Kentucky for items such

as clothing, shoes, jewelry, cleaning supplies, furniture, computer equipment, pre-written computer software, office supplies, books, souvenirs,

exercise equipment or subscribe to magazines, you may owe use tax to Kentucky. It is important to remember that use tax applies only to items

purchased from a retailer outside Kentucky, including another country, which would have been taxed if purchased in Kentucky.

For your convenience, a Use Tax Calculation Worksheet and Optional Use Tax Table are provided below. The Optional Use Tax Table is designed

for those purchases of less than $1,000. If you made untaxed out-of-state purchases in amounts under $1,000, but do not have records readily

available that show the amount of those purchases, you may use the Optional Use Tax Table below to estimate the compensating use tax based

on your Kentucky Adjusted Gross Income (KYAGI). All untaxed purchases in the amount of $1,000 or greater must be accounted for on an actual

basis using the Use Tax Calculation Worksheet. Failure to timely report may result in assessment of penalty and interest in addition to the tax

amount due.

Optional Use Tax Table

Use Tax Calculation Worksheet

Call 502-564-5170 for assistance.

KY AGI* Tax

$0 - $10,000 ....................................... $4

$10,001 - $20,000 ............................ $12

$20,001 - $30,000 ............................ $20

$30,001 - $40,000 ............................ $28

1. Purchases of $0 to $1,000

$40,001 - $50,000 ............................ $36

x 6 percent (.06)

$50,001 - $75,000 ............................ $50

$

OR Use Tax Table Amount

$75,001 - $100,000 .......................... $70

Above $100,000 ............................... Multiply AGI by 0.08%

2. Purchases of $1,000 or more

$

(0.0008)

x 6 percent (.06)

3. Total Use Tax Due (add lines 1 and

* AGI from Line 9 on KY Form 740 or KY Form 740-NP or Line

$

1 on KY Form 740-EZ.

2)

Report this amount on Form 740 or 740-NP, Line 27; or 740-EZ,

Line 9.

Credit Against the Kentucky Use Tax Due

You may reduce or eliminate the amount of Kentucky use tax due by the amount of state sales tax paid to the out-of-state seller on the same

transaction. The reduction may not exceed the amount of Kentucky use tax due on the purchase. For example, if Georgia state sales tax of 4

percent is paid, only the additional 2 percent is due to Kentucky, or if Illinois state sales tax of 6.25 percent is paid, no additional Kentucky use

tax is due. Sales tax paid to a city, county or another country cannot be used as a credit against Kentucky use tax due.

Need more information about use tax?

Visit our Web site at:

Call or write:

Monday—Friday

Kentucky Department of Revenue

8 a.m.—5:00 p.m., ET

Attention: Use Tax

P.O. Box 181, Station 53

(502) 564-5170

Frankfort, KY 40602-0181

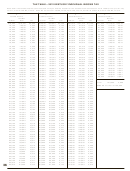

12

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76