INSTRUCTIONS

2012 FORM 740

Do You Have to File a Kentucky Return?

If you were a Kentucky resident for the entire year, your filing

KENTUCKY ADJUSTED GROSS INCOME

requirement depends upon your family size, modified gross

(Use Chart B if Modified Gross Income is Greater Than

income, Kentucky adjusted gross income and income from

the Amounts in Chart A)

self-employment. You must file if your modified gross income

exceeds the amount in Chart A and your Kentucky adjusted

Kentucky Adjusted Gross Income—Consists of your federal

gross income exceeds the amount in Chart B.

adjusted gross income plus any additions and subtractions

from Schedule M, Modifications to Federal Adjusted Gross

Complete your federal tax return first. If you are not required

Income.

to file a federal tax return, see instructions for Line 5.

MODIFIED GROSS INCOME AND FAMILY SIZE

(Use With Chart A)

Family Size—Consists of yourself, your spouse if married

Chart B

and living in the same household and qualifying children.

For the purposes of computing the Family Size Tax Credit,

Your Kentucky

the maximum family size is four.

Adjusted Gross Income

Qualifying Dependent Child—Means a qualifying child as

If Your Filing Status is:

is greater than:

defined in Internal Revenue Code Section 152(c), and includes

Single Person—

a child who lives in the household but cannot be claimed as a

Under age 65 ........................ and ................. $ 3,330

dependent if the provisions of Internal Revenue Code Section

152(e)(2) and 152(e)(4) apply. In general, to be a taxpayer’s

Single Person—

qualifying child, a person must satisfy four tests:

Age 65 or over or blind ........ and ................. $ 5,330

•

Relationship—The taxpayer’s child or stepchild (whether

by blood or adoption), foster child, sibling or stepsibling,

Single Person—

or a descendant of one of these.

Age 65 or over and blind ..... and ................. $ 6,600

•

Residence—Has the same principal residence as the

taxpayer for more than half the tax year. A qualifying child

Husband and Wife—

is determined without regard to the exception for children

Both under age 65 ................ and ................. $ 4,330

of divorced or separated parents. Other federal exceptions

apply.

Husband and Wife—

•

Age—Must be under the age of 19 at the end of the tax

One age 65 or over .............. and ................. $ 6,000

year, or under the age of 24 if a full-time student for at

Husband and Wife—

least five months of the year, or be permanently and totally

disabled at any time during the year.

Both age 65 or over ............. and ................. $ 7,100

•

Support—Did not provide more than one-half of his/her

own support for the year.

Modified Gross Income—Modified gross income is the greater

of federal adjusted gross income adjusted to include interest

income derived from municipal bonds (non-Kentucky) and

TAXPAYERS WITH SELF-EMPLOYMENT INCOME—Must file

lump-sum pension distributions not included in federal

a Kentucky individual income tax return regardless of the

adjusted gross income; or Kentucky adjusted gross income

amount of Kentucky adjusted gross income used in the Chart

adjusted to include lump-sum pension distributions not

B if you have gross receipts from self-employment in excess

included in federal adjusted gross income.

of modified gross income for your family size in Chart A.

Chart A

Your Modified Gross

If Your Family Size is:

Income is greater than:

TIP: Even though the filing requirements

One .......................... and .........................$11,170

are not met, an income tax return must be

Two ......................... and .........................$15,130

filed to claim a refund of the Kentucky taxes

Three ....................... and .........................$19,090

withheld.

Four or More .......... and .........................$23,050

7

1

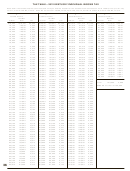

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76