Instructions for Schedule M—Modifications to Federal Adjusted Gross Income

elected the 20 percent capital gains rate for federal income

Additions to Federal Adjusted Gross Income

tax purposes (Schedule P and Form 4972-K required);

Line 1—Interest on securities issued by other states and

•

any mortgage debt forgiven under the Mortgage

their political subdivisions is taxed by Kentucky and must

Forgiveness Debt Relief Act of 2007;

be reported. Also report dividends received from regulated

•

the passive activity loss adjustment (see Form 8582-K and

investment companies (mutual funds) that are taxable for

instructions);

Kentucky income tax purposes. Note: Interest from securities

•

differences in pension (3-year recovery rule) and IRA

of Kentucky and its political subdivisions is exempt.

bases;

Line 2—Enter the self-employed health insurance deduction

•

differences in gains (losses) from the sale of intangible

from federal Form 1040, Line 29.

assets amortized under the provisions of the Revenue

Reconciliation Act of 1993; and

Line 3—Enter resident adjustment from Kentucky Schedule

•

differences in gains (losses) from the sale of depreciable

K-1. Partners, beneficiaries of estates and trusts and S

property placed in service after September 10, 2001.

corporation shareholders, see Kentucky Schedule K-1

instructions.

Note: Before entering the difference on Line 7 you must take

Line 4—Enter total depreciation from federal Form 4562

into account any addition or subtraction affecting the at–risk

if you have elected to take the 30 percent or 50 percent

limitations. See instructions for Line 19.

special depreciation allowance or the increased Section 179

deduction for property placed in service after September 10,

Line 8, Total Additions—Add Lines 1 through 7. Enter on

2001. See Line 16 for additional instructions.

Line 8 and on Form 740, page 1, Line 6.

Line 5—Enter federal net operating loss reported on Line 21

Subtractions from Federal Adjusted Gross Income

of 2012 federal Form 1040.

Line 9—Enter the amount of taxable state income tax refund

Line 6—Enter federal domestic production activities deduction

or credit reported on your federal return and included as

from federal Form 8903, line 25.

income on Form 740, page 1, Line 5.

Line 7—Enter other additions to federal adjusted gross

income not listed above (attach detailed schedule).

Line 10—Enter interest income from U.S. government

Include:

bonds and securities. Do not include taxable interest from

•

securities, such as FNMA (Fannie Mae), GNMA (Ginnie Mae)

Reservists and National Guard expenses reported on

and FHLMC (Freddie Mac), which are merely guaranteed by

federal Form 1040, line 24;

•

the U.S. government.

the portion of a lump-sum distribution on which you have

Line 11, Pension Income Exclusion—The 2012 exclusion amount is 100 percent of taxable retirement benefits or $41,110, whichever

is less. All pension and retirement income paid under a written retirement plan (qualified or unqualified) is eligible for exclusion.

This includes pensions, annuities, IRA accounts, 401(k) and similar deferred compensation plans, income received from convert-

ing a regular IRA to a Roth IRA, death benefits, disability retirement benefits and other similar accounts or plans.

This exclusion is for each taxpayer and must be computed independently of your spouse who may be filing on the same return. A

husband and wife must complete and claim their own exclusion, regardless of filing status. Joint filers—Combine the separately

computed pension exclusion amounts and enter on Schedule M, Line 11, Column B.

Pension Income Exclusion Worksheet

Column A

Column B

Step 1.

Spouse

Yourself

a. Enter taxable pension income reported on your federal Form 1040,

Line 15(b) or 16(b); Form 1040A, Line 11(b) or 12(b) ................................................. a

b. Enter disability retirement benefits on Form 1040, Line 7 or

Form 1040A, Line 7 ....................................................................................................... b

c. Enter deferred compensation reported on Form 1040, Line 7 or

Form 1040A, Line 7 ....................................................................................................... c

d. Add Lines a, b and c ..................................................................................................... d

Step 2. Line d is $41,110 or less. Enter the amount from Line d on Schedule M, Line 11.

Step 3. Line d is more than $41,110. Do you have retirement income from the

federal government, the Commonwealth of Kentucky or a Kentucky local

government; or supplemental U.S. Railroad Retirement Board benefits? ........................

Yes

No

Yes

No

If you answered no, enter $41,110 on Schedule M, Line 11.

If you answered yes, you must complete Schedule P to determine your pension

exclusion.

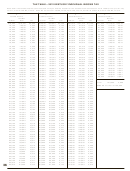

20

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76