Line 12, Qualified Mortgage Insurance Premiums—Premiums

January 1, 2007, are not deductible.

that you pay or accrue for “qualified mortgage insurance”

during 2012 in connection with home acquisition debt on

Limit on amount you can deduct. You cannot deduct your

your qualified home are deductible as home mortgage

mortgage insurance premiums if the amount on Form

insurance premiums. Qualified mortgage insurance

740, line 9, is more than $109,000 ($54,500 if married filing

is mor tgage insuranc e provided by the Veterans

separately on a combined return or separate returns). If the

Administration, the Federal Housing Administration, or

amount on Form 740, line 9, is more than $100,000 ($50,000

the Rural Housing Administration, and private mortgage

if married filing separately on a combined return or separate

insurance. Mortgage insurance premiums you paid or

returns), your deduction is limited and you must use the

accrued on any mortgage insurance contract issued before

worksheet below to figure your deduction.

Qualified Mortgage Insurance Premiums Deduction Worksheet

See the instructions for Line 12 above to see if you must use this worksheet to figure your deduction.

A.

B.

Spouse

Yourself (or Joint)

1. Enter the total premiums you paid in 2012

for qualified mortgage insurance for a

contract entered into on or after January 1, 2007 ....

1. _____________________

1. _____________________

2. Enter the amount from Form 740, Line 9 ...................

2. _____________________

2. ____________________

3. Enter $100,000 ($50,000 if married filing

separately on a combined return or

separate returns) ...........................................................

3. _____________________

3. ____________________

4. Is the amount on Line 2 more than the

amount on Line 3?

No. Your deduction is not limited.

Enter the amount from Line 1 above

on Schedule A, Line 12.

Yes. Subtract Line 3 from Line 2. If the

result is not a multiple of $1,000

($500 if married filing separately on

a combined return or separate returns),

increase it to the next multiple of

$1,000 ($500 if married filing

separately on a combined return or

separate returns). For example,

increase $425 to $1,000, increase

$2,025 to $3,000; or if married filing

separately on a combined return or

separate returns, increase $425 to

$500, increase $2,025 to $2,500, etc. ...........

4. _____________________

4. ______________________

5. Divide Line 4 by $10,000 ($5,000 if married

filing separately on a combined return or

separate returns). Enter the result as a

decimal. If the result is 1.0 or more,

enter 1.0 .........................................................................

5. _____________________

5. ______________________

6. Multiply Line 1 by Line 5 ..............................................

6. ____________________

6. _____________________

7. Qualified mortgage insurance premiums

deduction. Subtract Line 6 from Line 1 .......................

7. ____________________

7. _____________________

8. Add Line 7, Columns A and B. Enter here and

on Schedule A, Line 12 ......................................................................................................................................................

8. _____________________

Line 13, Interest on Investment Property—Investment interest

(c) you have no disallowed investment interest expense

is interest paid on money you borrowed that is allocable to

from 2011.

property held for investment. It does not include any interest

For more details, see federal Publication 550, Investment

allocable to a passive activity or to securities that generate

Income and Expenses.

tax-exempt income.

Complete and attach federal Form 4952, Investment Interest

Lines 15 through 19—Contributions

Expense Deduction, to figure your deduction.

You may deduct what you actually gave to organizations that

Exception. You do not have to file federal Form 4952 if all

are religious, charitable, educational, scientific or literary in

three of the following apply:

purpose. You may also deduct what you gave to organizations

(a) your investment interest is not more than your invest-

that work to prevent cruelty to children or animals. In general,

ment income from interest and ordinary dividends,

contributions deductible for federal income tax purposes are

(b) you have no other deductible investment expenses, and

also deductible for Kentucky.

24

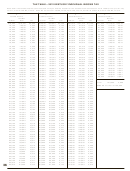

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76