Instructions for Form 2210-K

Purpose of Form—Use this form to determine if you owe an

required to make installment payments during the remainder

underpayment of estimated tax penalty for failing to prepay

of the year. Refer to the payment due dates at the top of

70% of your tax liability and/or interest for failing to make

columns A – D to determine how many installments you are

four equal estimated tax installments timely. You may be

required to make based on when your income changed or

subject to one or both even if you are due a refund when

was received.

you file your tax return.

If you are required to make 3 installments, multiply line 7 by

Underpayment of Estimated Tax Penalty—You may be

33.3 percent (.333) and enter in columns B through D.

charged an underpayment of estimated tax penalty if you

did not prepay 70% of your tax liability and you did not meet

If you are required to make 2 installments, multiply line 7 by

one of the exceptions listed in Part I.

50 percent (.50) and enter in columns C and D.

Estimated Tax Interest—You may also be charged interest if

If you are required to only make 1 installment, multiply line

you failed to make four equal installments timely pursuant

7 by 100 percent (1.00) and enter in column D.

to KRS 141.305. These payments are due by April 15, June

15, September 15 of the taxable year, and on January 15 of

Line 9—Enter the sum of estimated tax payments made and

the succeeding taxable year. Failure to make these equal

Kentucky withholding for each quarter. If you have Kentucky

installments timely may result in interest due pursuant to

income tax withheld, multiply the total by 25 percent (.25)

KRS 141.985. The interest is computed separately for each

and enter in columns A through D. If you had a credit forward

due date.

from a prior year return, enter the total amount in Column

A only.

Part I—Exceptions and Exclusions—The underpayment of

Note: Complete lines 10 through 17 for Column A before

estimated tax penalty may not apply if one of the exceptions

going to Column B, etc.

listed in Part I is met. If you meet one or more of the

exceptions, check the appropriate box(es), complete the lines

Line 10—Enter amount from line 17 of the previous column.

associated with the exception and check the “Form 2210-K

This amount should be the overpayment if any from the

attached” box on Form 740, line 41a (Form 740-NP, line 41a).

previous column.

If none of the exceptions apply, go to Part II.

Line 12—Enter amount from line 16 of the previous column.

Part II—Figuring the Underpayment and Penalty—Only

This amount should be the underpayment amount from the

complete this section if the additional tax due exceeds $500

previous column that will be carried over to each column

and you do not meet one of the exceptions listed in Part I.

until the payment is made.

Do not include amounts that were prepaid with extension or

payments made after the due date of the fourth declaration

Line 16—This is the underpayment amount for that column

installment. To avoid this penalty in the future, obtain and

and any underpayment from the previous columns. The

file Form 740-ES.

underpayment will continue to carryover to the next column

until the payment is made or the due date, whichever is

Part III—Required Annual Payment and Interest Calculation—

earlier.

This section is used to calculate your required annual

payment. The required annual payment is used to calculate

Figuring the Interest—Interest will be calculated on each

the amount of payment that you should have made each

underpayment in each column from the payment due date

quarter. If you do not pay the required amount in each quarter,

written above line 8 to the date on line 18 or the date the

you will be subject to interest until that payment is made.

payment was made, whichever is earlier. The underpayments

You may not be required to pay estimated tax payments if

will carryover to the next column and be added to that columns

you meet one of the following exceptions:

underpayment to calculate interest on that balance.

•

Taxpayer died during the taxable year

Line 18—Use this date to calculate the number of days that

•

Declaration was not required until after September 1,

the current interest amount will be based upon, unless the

2012, and the taxpayer files a return and pays the full

underpayment was paid prior to this date.

amount of the tax computed on the return on or before

February 1, 2013.

Line 19—This is the number of days from the payment due

•

Two–thirds (2/3) or more of the gross income was from

date shown above line 8 to the date the amount on line 16

farming; this return is being filed on or before March 1,

was paid or the date shown on line 18 for the column in which

2013; and the total tax due is being paid in full.

you are calculating interest.

•

Prepaid your last years tax liability with timely

For example, if your underpayment on line 16 for column A

payments.

is $1,000, you would calculate the interest from 4–15–12 to

Lines 1–7—Calculates your required annual payment which

6–15–12 and enter 61 days on line 19. If this $1,000 remains

is the lesser of your current years income tax liability or your

unpaid, it will be added to any underpayment in column B

previous years tax liability. If you have paid withholding that

and you would calculate interest from 6–15–12 until 9–15–12

exceeds the lesser of the two, you do not owe interest and

which would be 92 days for that period, etc.

you do not need to complete the rest of the form.

Line 20—The annual interest rate is established by the

Line 8—Multiply line 7, page 2, by 25 percent (.25) and enter

Department of Revenue for each calendar year. The interest

amount in columns A through D. However, if your source(s)

rate for calendar years 2012 and 2013 is 6 percent. The interest

of income changed unexpectedly throughout the year or your

calculation for the required third installment payment may

income was received later in the year, the required number

be calculated using two different interest rates.

of installments may be fewer.

A taxpayer who is not required to pay estimated tax in four

equal installments at the beginning of the year may be

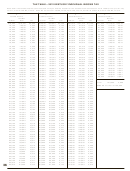

28

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76