Political contributions.

Examples of qualifying organizations are:

Dues, fees or bills paid to country clubs, lodges, fraternal

Churches, temples, synagogues, Salvation Army, Red

orders or similar groups.

Cross, CARE, Goodwill Industries, United Way, Boy

Value of any benefit, such as food, entertainment or mer-

Scouts, Girl Scouts, Boys and Girls Clubs of America,

chandise that you received in connection with a contribu-

etc.

tion to a charitable organization.

Fraternal orders if the gifts will be used for the purposes

Cost of raffle, bingo or lottery tickets.

listed above.

Cost of tuition.

Veterans’ and certain cultural groups.

Value of your time or service.

Nonprofit schools, hospitals and organizations whose

Value of blood given to a blood bank.

purpose is to find a cure for, or help people who have

The transfer of a future interest in tangible personal

arthritis, asthma, birth defects, cancer, cerebral palsy,

property (generally, until the entire interest has been

cystic fibrosis, diabetes, heart disease, hemophilia,

transferred).

mental illness or retardation, multiple sclerosis, muscular

Gifts to:

dystrophy, tuberculosis, etc.

Individuals.

Federal, state and local governments if the gifts are solely

Foreign organizations.

for public purposes.

Groups that are run for personal profit.

Groups whose purpose is to lobby for changes in the

If you contributed to a qualifying charitable organization

laws.

and also received a benefit from it, you may deduct only

Civic leagues, social and sports clubs, labor unions and

the amount that is more than the value of the benefit you

chambers of commerce.

received.

Line 15—Enter all of your contributions paid by cash or check

Contributions You MAY Deduct

(including out-of-pocket expenses).

Contributions may be in cash, property or out-of-pocket

Line 16—Enter your contributions of property. If you gave

expenses you paid to do volunteer work for the kinds of

used items, such as clothing or furniture, deduct their fair

organizations described above. If you drove to and from the

market value at the time you gave them. Fair market value is

volunteer work, you may take 14 cents a mile or the actual

what a willing buyer would pay a willing seller when neither

cost of gas and oil. Add parking and tolls to the amount you

has to buy or sell and both are aware of the conditions of

claim under either method. (Do not deduct any amounts that

the sale. If your total deduction for gifts of property is more

were repaid to you.)

than $500, you must complete and attach federal Form 8283,

Note: You are required to maintain receipts, cancelled checks

Noncash Charitable Contributions. If your total deduction is

over $5,000, you may also have to obtain appraisals of the

or other reliable written documentation showing the name of

the organization and the date and amount given to support

values of the donated property. See federal Form 8283 and

its instructions for details.

claimed deductions for charitable contributions.

Also include the value of a leasehold interest property con-

Separate contributions of $250 or more require written

tributed to a charitable organization to provide temporary

substantiation from the donee organization in addition to

housing for the homeless. Attach Schedule HH.

your proof of payment. It is your responsibility to secure sub-

stantiation. A letter or other documentation from the qualify-

Recordkeeping—If you gave property, you should keep a

ing charitable organization that acknowledges receipt of the

receipt or written statement from the organization you gave

contribution and shows the date and amount constitutes a

the property to, or a reliable written record, that shows the

receipt. This substantiation should be kept in your files. Do

organization’s name and address, the date and location of the

not send it with your return.

gift and a description of the property. You should also keep

See federal Publication 526 for special rules that apply if:

reliable written records for each gift of property that include

the following information:

your total contributions exceed 50 percent of Line 9, Form

740,

(a) How you figured the property’s value at the time you

your total deduction for gifts of property is over $500,

gave it. (If the value was determined by an appraisal,

you should also keep a signed copy of the appraisal.)

you gave less than your entire interest in the property,

your cash contributions or contributions of ordinary

(b) The cost or other basis of the property if you must reduce

income property are more than 30 percent of Line 9,

it by any ordinary income or capital gain that would have

Form 740,

resulted if the property had been sold at its fair market

your gifts of capital gain property to certain organizations

value.

are more than 20 percent of Line 9, Form 740, or

(c) How you figured your deduction if you chose to reduce

you gave gifts of property that increased in value, made

your deduction for gifts of capital gain property.

bargain sales to charity, or gave gifts of the use of

property.

(d) Any conditions attached to the gift.

(e) If the gift was a “qualified conservation contribution”

You MAY NOT Deduct as Contributions

under IRC Section 170(h), the fair market value of the

Travel expenses (including meals and lodging) while away

underlying property before and after the gift, the type

from home unless there was no significant element of

of legal interest donated and the conservation purpose

personal pleasure, recreation or vacation in the travel.

furthered by the gift.

25

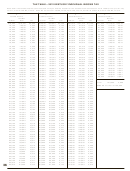

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76