Individuals who receive a federal

Interest and penalty charges can be

extension are not required to request a

avoided or reduced by sending payment

Federal Audit

separate Kentucky extension. They can

with your extension request by the due

meet the requirements by attaching a

date. If you wish to make a payment

Adjustments

prior to the due date of your return when

copy of the application for automatic

using the:

federal extension to the Kentucky

Taxpayers who have received a final

return.

determination of an Internal Revenue

(1) Kentucky Extension—Complete

Service audit must submit a copy

Section II, Kentucky Extension

IRS extensions by e-file (by

to the department within 30 days

Payment Voucher, of the Application

personal computer or a tax

of its conclusion. The information

for Extension of Time to File, Form

professional)—Attach a

should be submitted to the Individual

40A102, and send with payment.

copy of Form 4868 with the confirmation

Governmental Program Section,

Write “KY Income Tax—2012” and

number in the lower right-hand corner

Kentucky Department of Revenue,

your Social Security number(s) on

of the form or a copy of the electronic

P.O. Box 1074, Station 68, Frankfort,

the face of the check.

acknowledgment.

KY 40602-1074.

(2) Federal Automatic Extension—Make

Military Personnel—Kentucky residents

a copy of the lower portion of the

who are in the military are often granted

extensions for tax filings when serving

federal Application for Automatic

Confidentiality

Extension, Form 4868, and send

outside the United States. Any extension

with payment. Write “KY Income

granted for federal income tax purposes

Tax—2012” and your Social Secu-

will be honored for Kentucky income tax

Kentucky Revised Statute 131.190 requires

rity number(s) on the face of the

purposes.

the Department of Revenue to maintain

check.

strict confidentiality of all taxpayer

Combat Zone Extension—Members

records. No employee of the Department

of the Army, Navy, Marines, Air Force,

of Revenue may divulge any information

or Public Health Service of the United

regarding the tax returns, schedules or

Personal Property

States government who serve in an

reports required to be filed. However,

area designated as a combat zone by

Forms

the Department of Revenue is not

presidential proclamation shall not be

prohibited from providing evidence to or

required to file an income tax return and

testifying in any court of law concerning

Kentucky business taxpayers are

pay the taxes, which would otherwise

official tax records. Also, Department

reminded to report all taxable personal

become due during the period of service,

of Revenue employees or any other

property, except motor vehicles, owned

until 12 months after the service is

person authorized to access confidential

on January 1 to either the property

completed. Members of the National

state information are prohibited from

valuation administrator in the county of

Guard or any branch of the Reserves

intentionally viewing such information

residence (or location of business) or the

called to active duty to serve in a combat

without an official need to view.

Office of Property Valuation in Frankfort.

zone are granted the same extension.

Tangible personal property

The department may provide official

is to be reported on the

Interest and Penalties—Interest at the

information on a confidential basis to the

Tangible Personal Property

“tax interest rate” applies to any income

Internal Revenue Service or to any other

Tax Return, Form 62A500.

tax paid after the original due date of the

governmental agency with which it has

The due date for this return is May 15.

return. If the amount of tax paid by the

an exchange of information agreement

Do not mail this return with your income

original due date is less than 75 percent

whereby the department receives similar

tax return; use a separate envelope.

of the tax due, a late payment penalty

or useful information in return.

may be assessed (minimum penalty is

$10).

Extension of Time

to File

Taxpayers who are unable to file a return

Kentucky Department of Revenue

Mission Statement

by April 15 may request an extension.

The request for the extension must be

As part of the Finance and Administration Cabinet, the mission of the Kentucky

submitted in writing to the Department

Department of Revenue is to administer tax laws, collect revenue, and provide services

of Revenue on or before the due date

in a fair, courteous, and efficient manner for the benefit of the Commonwealth and

of the return. The request must state

its citizens.

a reasonable cause for the inability to

file. Inability to pay is not an acceptable

* * * * * * * * * * * * * * * * * *

reason. Acceptable reasons include, but

are not limited to, destruction of records

The Kentucky Department of Revenue does not discriminate on the basis of race,

by fire or flood and serious illness of

color, national origin, sex, age, religion, disability, sexual orientation, gender identity,

the taxpayer. Extensions are limited

veteran status, genetic information or ancestry in employment or the provision of

to six months. A copy of the Kentucky

services.

extension request must be attached to

the return.

5

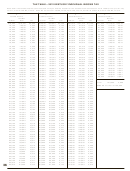

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76