Instructions for Schedule A

Do not include on Schedule A items deducted elsewhere, such as on Schedule C, C-EZ, E, F or Kentucky Schedule M.

You may itemize your deductions for Kentucky even if you do

Medical aids such as hearing aids (and batteries), false

not itemize for federal purposes. Generally, if your deductions

teeth, eyeglasses, contact lenses, braces, crutches,

exceed $2,290, it will benefit you to itemize. If you do not

wheelchairs, guide dogs and the cost of maintaining

itemize, a standard deduction of $2,290 is allowed.

them.

Special Rules for Married Couples—If one spouse itemizes

Lodging expenses (but not meals) paid while away from

deductions, the other must also itemize. Married couples

home to receive medical care in a hospital or a medical

filing a joint federal return and who wish to file separate

care facility that is related to a hospital. Do not include

returns or a combined return for Kentucky may: (a) file

more than $50 a night for each eligible person.

separate Schedules A showing the specific deductions

Ambulance service and other travel costs to get medical

claimed by each, or (b) file one Schedule A and divide the

care. If you used your own car, you may claim what

total deductions between them based on the percentage of

you spent for gas and oil to go to and from the place

each spouse’s income to total income.

you received the care; or you may claim mileage. The

Lines 1 through 3—Medical and Dental Expenses

mileage rate is 23 cents per mile. Add parking and tolls

to the amount you claim under either method.

You may deduct only your medical and dental expenses that

exceed 7.5 percent of Line 9, Form 740. Include all amounts

The supplemental part of Medicare insurance (Medicare B).

you paid during 2012 but do not include amounts which

To claim these expenses, see instructions for Schedule

have been previously deducted; paid by hospital, health or

M, Line 14.

accident insurance; or paid by your employer. Federal rules

apply for reimbursement.

Surgery to improve vision including radial keratotomy or

other laser eye surgery.

When you compute your deduction, you may include medical

and dental bills you paid for:

Examples of Medical and Dental Payments

Yourself.

You MAY NOT Deduct

All dependents you claim on your return.

You may not deduct payments for the following:

Your child whom you do not claim as a dependent because

of the rules for Children of Divorced or Separated

Elective cosmetic surgery.

Parents.

Hospital, medical and extra Medicare B insurance. To

Any person that you could have claimed as a dependent

claim these expenses, see instructions for Schedule M,

on your return if that person had not received $3,650 or

Line 14.

more of gross income or had not filed a joint return.

The basic cost of Medicare insurance (Medicare A).

Examples of Medical and Dental Payments

(Note: If you are 65 or over and not entitled to Social

You MAY Deduct

Security benefits, you may deduct premiums you vol-

untarily paid for Medicare A coverage.)

To the extent you were not reimbursed, you may deduct

what you paid for:

Life insurance or income protection policies.

Medicines and drugs that required a prescription, or

Long-term care insurance premiums. To claim, see

insulin.

instructions for Schedule M, Line 13.

Medical doctors, dentists, eye doctors, chiropractors,

The hospital insurance benefits (Medicare) tax withheld

osteopaths, podiatrists, psychiatrists, psychologists,

from your pay as part of the Social Security tax or paid

physical therapists, acupuncturists and psychoanalysts

as part of Social Security self-employment tax.

(medical care only).

Nursing care for a healthy baby.

Medical examinations, X-ray and laboratory services,

Illegal operations or drugs.

insulin treatment and whirlpool baths your doctor

ordered.

Medicines or drugs you bought without a prescription.

Nursing help. If you paid someone to do both nursing and

Travel your doctor told you to take for rest or change.

housework, you may deduct only the cost of the nursing

help.

Funeral, burial or cremation costs.

Hospital care (including meals and lodging), clinic costs

See federal Publication 502 for more information on allow-

and lab fees.

able medical and dental expenses including deductions

for capital expenditures and special care for persons with

Medical treatment at a center for drug or alcohol

disabilities.

addiction.

22

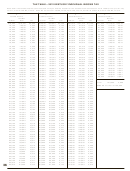

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76