Line 2, Kentucky Small Business Investment Credit—For

taxable years beginning after December 31, 2010, a small

SECTION A—BUSINESS INCENTIVE AND OTHER TAX

business may be eligible for a nonrefundable credit of up

CREDITS

to one hundred percent (100%) of the Kentucky income

Line 1, Nonrefundable Limited Liability Entity Tax Credit (KRS

tax imposed under KRS 141.020 or 141.040, and the limited

141.0401(2))

liability entity tax imposed under KRS 141.0401.

An individual that is a partner, member or shareholder of

The small business development credit program authorized

a limited liability pass–through entity is allowed a limited

by KRS 154.60-020 and KRS 141.384 was amended to allow

liability entity tax (LLET) credit against the income tax imposed

the credit to apply to taxable years beginning after Dec. 31,

by KRS 141.020 equal to the individual’s proportionate share

2010. The definition of base year for purposes of the credit

of LLET computed on the gross receipts or gross profits of

computation was changed to the first full year of operation

the limited liability pass–through entity as provided by KRS

that begins on or after Jan.1, 2009 and before Jan. 1, 2010.

141.0401(2), after the LLET is reduced by the minimum tax

of $175 and by other tax credits which the limited liability

Small businesses are eligible to apply for credits and receive

pass–through entity may be allowed. The credit allowed an

final approval for these credits one (1) year after the small

individual that is a partner, member, or shareholder of a

business:

limited liability pass-through entity against income tax shall

be applied only to income tax assessed on the individual’s

•

Creates and fills one (1) or more eligible positions over

proportionate share of distributive income from the limited

the base employment, and that position or positions are

liability pass–through entity as provided by KRS 141.0401(3)

created and filled for twelve (12) months; and

(b). Any remaining LLET credit shall be disallowed and shall

not be carried forward to the next year.

•

Invests five thousand dollars ($5,000) or more in

qualifying equipment or technology.

Nonrefundable Kentucky limited liability entity tax credit

The small business shall submit all information necessary to

(KRS 141.0401(2))—The credit amount is shown on Kentucky

the Kentucky Economic Development Finance Authority to

Schedule(s) K–1 from pass-through entities (PTEs) or Form(s)

determine credit eligibility for each year and the amount of

725 for single member limited liability companies. Copies of

credit for which the small business is approved.

Kentucky Schedule(s) K-1 or Form(s) 725 must be attached

to your return.

A small business that is a pass-through entity not subject

to the tax imposed by KRS 141.040 and that has tax credits

Kentucky Limited Liability Entity Tax Credit Worksheet

approved under Subchapter 60 of KRS Chapter 154 shall apply

the credits against the limited liability entity tax imposed by

Complete a separate worksheet for each LLE. Retain for your

KRS 141.0401, and shall also distribute the amount of the

records.

approved tax credits to each partner, member, or shareholder

based on the partner’s, member’s, or shareholder’s distributive

Name __________________________________________________

share of income as determined for the year during which the

tax credits are approved.

Address ________________________________________________

The maximum amount of credits that may be committed

FEIN ___________________________________________________

in each fiscal year by the Kentucky Economic Development

Finance Authority shall be capped at three million dollars

Percentage of Ownership ....................... ______________ %

($3,000,000).

1. Enter Kentucky taxable income

The maximum amount of credit for each small business

from Form 740, Line 11 ...................... ________________

for each year shall not exceed twenty-five thousand dollars

2. Enter LLE income as shown

($25,000). The credit shall be claimed on the tax return for

on Kentucky Schedule K-1

the year during which the credit was approved. As per KRS

or Form 725 ........................................ ________________

141.0205, individuals entitled to this credit will claim the

3. Subtract Line 2 from Line 1 and

credit on Line 2, Section A – Business Incentive and Other

enter total here ................................... ________________

Tax Credits.

4. Enter Kentucky tax on income

amount on Line 1 ................................ ________________

Unused credits may be carried forward for up to five (5)

5. Enter Kentucky tax on income

years.

amount on Line 3 ................................ ________________

6. Subtract Line 5 from Line 4. If Line 5

Line 3, Skills Training Investment Tax Credit—Enter the

is larger than Line 4, enter zero.

amount of credit certified by the Bluegrass State Skills

This is your tax savings if income

Corporation. A copy of the Kentucky Schedule K-1 for the

is ignored ............................................ ________________

year the credit was approved must be attached to the return

7. Enter nonrefundable limited liability

in the first year the credit is claimed. The excess credit over

entity tax credit (from Kentucky

the income tax liability in the year approved may be carried

Schedule K-1 or Form 725) ............... ________________

forward for three successive taxable years. For information

8. Enter the lesser of Line 6 or Line 7.

regarding the application and approval process for this credit,

This is your credit. Enter here and

contact the Cabinet for Economic Development, Bluegrass

on Form 740, Section A, Line 1 ......... ________________

State Skills Corporation at (502) 564-2021.

15

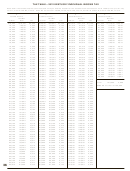

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76