Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 10

ADVERTISEMENT

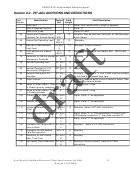

FEDSTATE Generic Record Layout

Section 3.2 - FEDSTATE rejected tax returns:

New Mexico WILL REJECT tax returns IF:

1. The date fields DO NOT follow specifications i.e. format must be

MMDDCCYY.

2. Direct debit indicator/flag is NOT set to ‘2’ when direct debit date

and direct debit amount is greater than zero.

3. Total exemptions DO NOT compute. [PIT-S dependents plus

taxpayer and/or spouse must equal total exemptions claimed]

4. Computer software product has not been approved by NM

5. Line entries where “attach PIT-ADJ, B, CR, D, RC” AND FORM IS

M ISSING

Acknowledgement files must be checked for rejects.

Rejected tax returns must be re-submitted.

1. Return reject errors on acknowledgement:

0001 date format must be mmddccyy

0002 Direct Debit flag must be ‘2’

0003 Total exemptions do not compute.

(PIT-S dependents plus taxpayer and/or spouse must equal total

exemptions claimed)

0004 Software product not approved by NM

0010 PIT-ADJ, form REQUIRED not attached

0013 Filing Status not entered

0020 Rate schedule_royalty_check_err (rate/schedule B or

R or Y)

0021 Pit-b_supporting_form_err (B is checked but PIT-B

form not attached)

0030 Pit_RC_supporting_form_err (form RC not attached)

0040 Pit_CR_supporting_form_err (form CR not attached)

Section 4 – Software developer provisions

New Mexico Fed/State Electronic Filing Specifications for 2008

10

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41