Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 15

ADVERTISEMENT

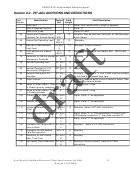

FEDSTATE Generic Record Layout

********** STATE DIRECT DEPOSIT OR DIRECT DEBIT SECTION **********PIT-1 cont’d

Field

Identification

Form

Field

Field Description

Number

Refs.

Length

024

Direct Deposit or

1

Alphanumeric. 1 = Direct Deposit

Direct Debit Indicator

[REQUIRED] 2 = Direct Debit, blank if neither

025

Reserved-RTN-Flag

1

Numeric. Must be a zero.

0

2

7

D

i

r

e

c

t

D

e

b

i

t

D

a

t

e

8

N

u

m

e

r

i

c

M

M

D

D

C

C

Y

Y

0

2

7

D

i

r

e

c

t

D

e

b

i

t

D

a

t

e

8

N

u

m

e

r

i

c

M

M

D

D

C

C

Y

Y

028

Direct Debit Amount

12

Numeric. If Direct Debit Indicator [024] = 2 and tax due [445]

greater than zero

030

State or Tax Payer

PIT-1-

9

Numeric. For direct deposit or direct debit, blank if neither.

Routing Transit No.

Back

032

State-RTN-Indicator

1

Numeric, o = No State RTN 1 = State RTN on FOMF

2 = State RTN not on FOMF [IRS USE ONLY]

035

State-Deposit or TP

PIT-1-

17

Alphanumeric, tax payer bank deposit acct for refund or tax

Debit Acct. No.

Back

payer bank acct for direct debit, else blank

040

State-Checking-Acct.

PIT-1-

1

Alphanumeric. Value = “X”, If from/to checking acct and if

Back

fields [030] and [035] contain bank acct number and field

[048] must be blank; otherwise blank

048

State-Savings-Acct.

PIT-1-

1

Alphanumeric. Value = “X”, if from/to savings acct and if fields

Back

[030] and [035] contain account number and field [040] must

be blank; otherwise blank.

********** PARTICIPANT SECTION **********

********** INDICATORS **********

049

Online-State-Return

1

Alpha. Value “O” = Online.

050

State Numeric Area

27

Numeric. [REQUIRED]

a

Preparer SSN / TIN

9

Alphanumeric. 1040 sequence 1360; SSN / first position =

P (paid preparer) or S (volunteer) id number

b

Preparer EIN

9

Numeric. 1040 Seq. 1380

c

Preparer ZIP

5

Numeric. 1040 Seq. 1410-5

d

Preparer ZIP+4

4

Numeric. 1040 Seq. 1410-4

052

State Alphanumeric

93

Alphanumeric. NM [REQUIRED]

Area

a

Mailbox ID

5

Alphanumeric or blank.(Software code)

b

Preparer Firm Name

35

Alphanumeric or blank. 1040 Seq. 1370

c

Preparer Address

30

Alphanumeric or blank.

d

Preparer City

20

Alphanumeric or blank. 1040 Seq. 1390

e

Preparer State

2

Alphanumeric or blank. 1040 Seq. 1400

f

Preparer Self-

1

Alphanumeric or blank. 1040 Seq. 1350

employed Indicator

New Mexico Fed/State Electronic Filing Specifications for 2008

15

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41