Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 18

ADVERTISEMENT

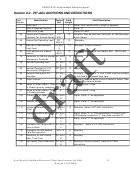

FEDSTATE Generic Record Layout

********** ALPHANUMERIC SECTION **********PIT-1 cont’d

Field

Identification

Form

Field

Field Description

Number

Refs.

Length

300

Alphanumeric Field 1

80

a

Software Developer

10

NM Required, assigned by NM Fed/State Coordinator with test

Code

package, and required for production (NNNNN-NN).

b

Paid Preparer Name

31

Alphanumeric. 1040 Seq. 1340 Name of ERO. NM required.

c

Preparer Phone

10

Alphanumeric. ERO phone number. NM required.

Number

d

Non-Paid Preparer

13

Alphanumeric or blank. 1040 Seq. 1338

e

Preparer State EIN

16

Numeric. NM CRS ID Number, 11 digits right-justified, zero-filled,

Pit-

1-

assigned by TRD. Required for in-state NM tax professional

back

prepared returns. Zeros should indicate self-prepared returns

bottom

305

Alphanumeric Field 2

80

Alphanumeric.

305.010 Return Type

1

Alphanumeric. Required. “1” for PIT-1

305.020 New Address

PIT-1-

1

Alpha. Value “Y” as applicable.

top

305.030 Primary Residence

PIT-1-

1

Alpha. “R”, “N”, “P”, or “F” as applicable. [R=Resident,

status

top

N=Nonresident, P=Part year resident, F=First year resident}

305.040 Spouse Residence

PIT-1-

1

Alpha. “R”, “N”, “P” or “F” as applicable.

status

top

305.050 Deceased Taxpayer

PIT-1-

1

Alpha. Value “Y” as applicable.

Indicator

top

305.060 Deceased Spouse

PIT-1-

1

Alpha. Value “Y” as applicable. Federal Filing Status must be

Indicator

top

equal to 2 (Married Filing Jointly) for this field to have a value of

“Y”.

305.065 Fed form 8886

PIT-1-

1

Alpha. Value “X” if Fed form 8886 required else “blank”

indicator

6

305.070

5

Blank

305.080 Claimant’s First

PIT-1-

20

Alpha. If Deceased Taxpayer or Spouse [305.050, 305.060] is “Y”

Name

top

must be name of claimant else it must equal blank.

305.083 Claimant’s Middle

PIT-1-

1

Alpha. If Deceased Taxpayer or Spouse [305.050, 305.060] is “Y”

Initial

top

must be initial of claimant else it must equal blank.

305.085 Claimant’s Last

PIT-1-

25

Alpha. If Deceased Taxpayer or Spouse [305.050, 305.060] is “Y”

Name

top

must be name of claimant else it must equal blank.

305.087 Claimant’s

PIT-1-

3

Alpha. If Deceased Taxpayer or Spouse [305.050, 305.060] is “Y”

Generation Suffix

top

must be suffix of claimant else it must equal blank.

305.090 Claimant’s SSN

PIT-1-

9

Numeric. If Deceased Taxpayer or Spouse [305.050, 305.060] is

top

“Y” must be claimant’s SSN else it must equal zeros.

305.100 Amended Return

PIT-1

1

Alpha. Value “N” Amended NOT Available

305.105 Extension Indicator

PIT-1

1

Alpha. Value = “X” or blank.

3

305.110 Extension Date

PIT-1

8

Numeric. Date format MMDDCCYY granted by federal or NM for

3

extension of time to file. Zero if none

New Mexico Fed/State Electronic Filing Specifications for 2008

18

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41