Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 17

ADVERTISEMENT

FEDSTATE Generic Record Layout

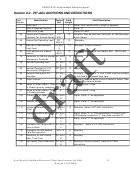

********** CONSISTENCY SECTION **********PIT-1 cont’d

Field

Identification

Form

Field

Field Description

Number

Refs.

Length

150

Fed Filing Status

PIT-1-4

1

Numeric. Must be equal to 1, 2, 3, 4, or 5. Required Entry. NM

required.

PIT-1-2

155

Total Fed

2

Numeric. Must be greater than zero if Federal Filing Status is not

Exemptions

equal to 1. Derived by the addition of Number of Primary and

Spouse Exemptions plus Number of Dependents. NM required.

PIT-RC-

1

160

Wages, Salaries,

12

Monetary.

Tips

165

Taxable Interest

12

Monetary.

170

Tax Exempt Interest

12

Monetary.

175

Dividends

12

Monetary.

180

State Refund

12

Monetary.

185

Taxable Social

12

Monetary.

Security Benefits

190

Keogh Plan and Sep

12

Monetary.

Deductions

195

Federal Adjusted

PIT-1-7

12

Monetary. May be negative. Required.

Gross Income

200

Standard/Itemized

12

Monetary.

Deductions

205

Earned Income

12

Monetary.

Credit

New Mexico Fed/State Electronic Filing Specifications for 2008

17

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41