Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 13

ADVERTISEMENT

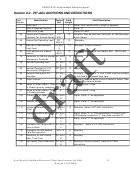

FEDSTATE Generic Record Layout

N = NUMERIC - 0 through 9 Numeric characters only; right-justified, pre-fill with zeros.

$ = MONETARY - Whole dollars; must be non-negative unless otherwise indicated. No

dollar signs, decimal points or other non-numeric characters, the standard will be SIGN

TRAILING SEPARATE. A separate one-byte field immediately following the numeric

value must contain the sign. For a positive amount or zero, the sign must be a "+"; for a

negative amount, the sign must be a "-". Examples: A field defined as 12 bytes

monetary will have the picture of 9(11)s; a field defined as 10 bytes monetary will be

9(09)s where 's' is the sign.

D = DATE fields - M = Month, D = Day, C=century, Y = Year. Always MMDDCCYY.

AN = ALPHANUMERIC - A through Z (uppercase only), 0 through 9 and the special

characters ampersand (&), blank ( ), comma (,), hyphen (-), period (.); pre-fill with

spaces.

The second part of the field description defines the hard-coded values and requirements

for transmittal. Fields designated as "unused", "blank", or "blank when zero" may be

excluded from the transmittal. Fields designated as "NM required" are required for NM

return acceptance, though not necessarily for Federal transmittal. The entire "Header

Section" must be included. All logical characters in the "PARTICIPANT Section" [050],

"State Alphanumeric Area" [052], "Name/Address Line(s)" [060], [065], [070], [075],

[080], [085], [095] and [100] and "Alphanumeric Field 1" [300] must be accounted for to

transmit a NM return. "Consistency Section" fields, which are required, are Federal

Filing Status, Total Federal Exemptions, and Adjusted Gross Income ([150], [155],

[195]).

SIGNED FIELD TRANSMITTAL, VARIABLE BYTE COUNTS, & FIELD

USAGE

If a fixed record is transmitted the sign must be " " (blank) when positive or "-" when

negative. The character "+" is disallo wed unless the field is high-order zero-filled.

If a variable record is transmitted, the character "+" is allowed. The character "+" is also

allowed if the field is properly zero-filled.

Every character including Federal and State field numbers and delimiters is counted in

the byte count for variable Generic records. The byte count itself and record terminus

are also counted as five (5) characters.

Usage of any field not in the Consistency Section on the Generic record is up to the

State's discretion such that a name field of twenty-five (25) characters may be used for

a twenty (20)-character name and five (5) miscellaneous characters such as flags. The

Federal process will check its existence, but not its value.

New Mexico Fed/State Electronic Filing Specifications for 2008

13

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41