Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 32

ADVERTISEMENT

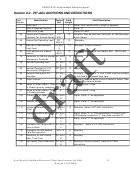

FEDSTATE Unformatted Record Layout

PIT-B cont’d

Field

Identification

Forms

Field

Field Description

Number

Refs.

Length

195

Total NM Taxes

PIT-B -14

12

Monetary. Using tax rate tables find the tax

applicable to NM Taxable Income on PIT-1 [385

Generic] plus Additional amount for Tax on lump-sum

distributions [395 Generic].

200

NM Gross Income Tax

PIT-B -15

12

Monetary. Multiply Total NM Taxes NM Percentage.

[195] X [190]

PIT-B -P2

205

Business and Farm Income

12

Monetary.

Property Value –

Everywhere

1a col-1

PIT-B -P2

210

Business and Farm Income

12

Monetary. Must not be greater than Business and

Property Value – NM

Farm Income Property Value – Everywhere. [205]

1a col-2

PIT-B -P2

215

Property Factor

12

Numeric. Compute to three decimal places. Must be

non-negative. Divide Business and Farm Income

Property Value–NM by Business and Farm Income

1b

Property Value – Everywhere. [210 / 205]

220

Business and Farm Income

PIT-B -P2

12

Monetary. Refer to PIT-B instructions

Payroll Paid – Everywhere

2a col-1

225

Business and Farm Income

PIT-B -

12

Monetary. Must not be greater than field Business and

Payroll Paid – NM

P22a col-2

Farm Income Payroll Paid – Everywhere.[220]

230

Payroll Factor

PIT-B -P2

12

Numeric. Compute to three decimal places. Must be

2b

non-negative. Divide Business and Farm Income

Payroll Paid – NM by Business and Farm Income

Payroll Paid – Everywhere.[225 / 220]

235

Business and Farm Income

PIT-B -P2

12

Monetary.

Sales – Everywhere

3a col-1

240

Business and Farm Income

PIT-B -P2

12

Monetary. Must not be greater than Business and

Sales – NM

3a col-2

Farm Income Sales – Everywhere.[235]

PIT-B -P2

245

Sales Factor

12

Numeric. three decimal places. Must be > zero.

Divide Business and Farm Income Sales – NM by

Business & Farm Income SalesEvery. [240 / 235]

3b

PIT-B -P2

250

Total Factor

12

Numeric. Compute to three decimal places. Must be

non-negative. Add Property Factor, Payroll Factor,

and Sales Factor. [215+230+245]

4

PIT-B -P2

255

Average Factor

12

Numeric. Compute to three decimal places. Must be

non-negative. Divide Total Factor by the count of

fields Property Factor, Payroll Factor, and Sales

5

Factor with a value > 0 [250/ number of factors used]

260

Method of Apportionment

PIT-B -P2

8

Numeric. Date Format MMDDCCYY

effective date

bottom

Record Segment Terminus

1

Alphanumeric. Value is "$".

New Mexico Fed/State Electronic Filing Specifications for 2008

32

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41