Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 14

ADVERTISEMENT

FEDSTATE Generic Record Layout

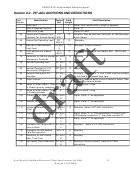

Section 5.2 –FEDSTATE Generic record layout (PIT-1)

Field

Identification

Form

Field

Field Description

Number

Refs.

Length

********* HEADER SECTION ***********

Byte Count, Page 1

4

Numeric. 2754 for fixed; nnnn for variable format.

Start of Record

4

Value “****”

Sentinel

000

Record ID Type

6

Value “STbbbb”

001

Form Number

6

Value “0001bb”.

002

Page Number

5

Value “PG01b”.

003

Taxpayer

PIT-1-1

9

Numeric. SSN of primary taxpayer.

Identification Number

004

Filler

1

Blank.

005

Form/Schedule

7

Numeric. Value “0000001”.

Number

010

State Code

2

Alpha. Value equal “NM”.

011

City Code

2

Alpha. Reserved for Future. Fill with blanks.

015

Imperfect Return

1

Alpha ‘E’ = Exception Processing or blank IRS Use Only

Indicator

016

ITIN/SSN Mismatch

1

A Value “M” = Mismatch or Blank (IRS USE ONLY)

indicator

019

State Only Return

2

Alpha. Value equal “SO” for State Only Returns

020

Declaration Control

14

Numeric, assigned by filer. [REQUIRED]

Number

a

First Two Positions

2

Numeric. Value always “00”.

b

EFIN of Originator

6

Numeric.

c

Batch Number

3

Numeric. (000-999)

d

Serial Number

2

Numeric. (00-99)

e

Year Digit

1

Numeric. Value “9”

023

Return Sequence

16

Numeric. [Required Entry].

Number

Must Equal RSN in 1040, 1040-A or 1040-EZ.

a

ETIN of Transmitter

5

Numeric.

b

Transmitter Use Field

2

Numeric.

c

Julian Date of

3

Numeric.

Transmission

d

Transmission

2

Numeric. (01-99)

Sequence Number

e

Sequence Number of

4

Numeric. (0001-9999)

Return

New Mexico Fed/State Electronic Filing Specifications for 2008

14

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41