Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 28

ADVERTISEMENT

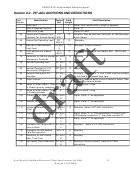

FEDSTATE Unformatted Record Layout

PIT-RC cont’d

Field

Identification

Forms

Field

Field Description

Number

Ref.

Length

162

Section II - LICTR Total exemptions

PIT-RC

2

Numeric

from line 3

P2,13a

230

Section II – Low income

PIT-RC-

12

Monetary. Refer to PIT-RC instructions.

Low Income Comprehensive Tax

P2,14

Rebate(LICTR)

235

Section III – 65 or Older (prop tax

PIT-RC-

12

Monetary. If Primary Taxpayer Age < 65 and Spouse

rebate) Property Owned Tax Billed

P2,15

Age < 65 then this field must be equal to zero.

240

Property rented - Rent Paid

PIT-RC-

12

Monetary. If Primary Taxpayer Age < 65 and Spouse

P2,16a

Age < 65 then this field must be equal to zero.

242

Rent paid by government entity

PIT-RC-

1

Numeric, enter ‘1’ if true

P2,16

245

Rent Paid Allowable

PIT-RC-

12

Monetary. Multiply Rent Paid [240] by .06.

P2,16b

250

Total Property Tax Billed and Rent

PIT-RC-

12

Monetary. Add Property Tax Billed and Rent Paid

Allowable

P2,17a

Allowable. [235+245]

255

Maximum Property Tax Liability

PIT-RC-

12

Monetary. Derived according to Modified Gross Income

P2,17b

[160] and reference to the 2008 Maximum Property Tax

Liability Table included with the 2008 PIT form

instructions. If Modified Gross Income [160] is greater

than $16,000 then this field must equal zero.

260

Property Tax Rebate

PIT-RC-

12

Monetary. Subtract Maximum Property Tax Liability

P2,17c

[255] from Total Property Tax Billed and Rent Allowable

[250]. Maximum is $250. If Federal Filing Status [150] is

equal to 3 (Married Filing Separate) then this value

must be divi ded by two and the maximum value is

($125). If Modified Gross Income [160] is greater than

$16,000 then this field must equal zero. The values of:

,

Resident Question [50]

Physically Present Question

[55], and Dependent Question [60] must be “Y”, “Y” and

“N” respectively for this field to have a value > zero.

265

Section IV – (LICTR) Los Alamos

PIT-RC-

12

Monetary. Positive numeric. Los Alamos County

Los Alamos Property Owned

P2,18a

residents only

270

Los Alamos Property Tax

PIT-RC-

12

Percentage. Positive numeric. Two decimal places to

Percentage

P2,18b

the right of the decimal point. Derived according to MGI

[160] and reference the 2008 Los Alamos County

Property Tax Rebate Percentage Table included with

the 2008 PIT form instructions. If MGI [160] is >

$24,000 this field must be zero.

New Mexico Fed/State Electronic Filing Specifications for 2008

28

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41