Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 27

ADVERTISEMENT

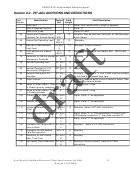

FEDSTATE Unformatted Record Layout

PIT-RC cont’d

Field

Identification

Forms

Field

Field Description

Number

Ref.

Length

80

Members DO NOT qualify

2a

2

Numeric

84

Allowable household members

2b

2

Numeric ([116] – [75])

88

Extra primary blind exemption

2c1

1

Numeric

92

Extra spouse blind exemption

2c2

1

numeric

96

Add number of boxes check here

2c

1

numeric

100

Add lines 2b and 2c

2d

1

numeric

119

LICTR If primary greater than 65

2e

1

Numeric

120

If Married Jointly and spouse > 65

2f

1

Numeric

121

If file status (3) MFS, enter spouse

2h

2

Numeric

exemptions

122

LICTR Add lines [total allowable

3

2

Numeric

members/exemptions]

124

Wages, salaries, tips

PIT-RC-

12

Monetary.

4

125

Social Security Benefits, Pensions &

PIT-RC-

12

Monetary.

Annuities

5

130

Unemployment and Worker’s

PIT-RC-

12

Monetary.

Compensation Benefits

6

135

Public Assistance, AFDC, Welfare

PIT-RC-

12

Monetary.

Benefits and SSI

7

Field

Identification

Forms

Field

Field Description

Number

Ref.

Length

140

Net Profit from Business, Farm or

PIT-RC-

12

Monetary. If a loss enter zero.

Rentals

8

145

Capital Gains

PIT-RC-

12

Monetary.

9

150

Gifts of Cash or Tangible Items

PIT-RC-

12

Monetary.

10

155

Other Income

PIT-RC-

12

Monetary.

11

160

Modified Gross Income

PIT-RC-

12

Monetary. Add Wages, Salaries, Tips; Social Security

12 & RC

Benefits, Pensions, Annuities, and Railroad Retirement;

P2,13

Unemployment and Worker’s Compensation Benefits;

Public Assistance, AFDC, Welfare Benefits and SSI;

Net Profit from Business, Farm or Rentals; Capital

Gains; Gifts of Cash or Tangible Items; Other Income.

[195 Generic].

[124+125+130+135+140+145+150+155]

New Mexico Fed/State Electronic Filing Specifications for 2008

27

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41