Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 19

ADVERTISEMENT

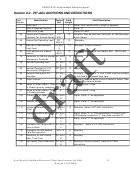

FEDSTATE Generic Record Layout

PIT-1 cont’d

Field

Identification

Form

Field

Field Description

Number

Refs.

Length

310

Alphanumeric Field 3

80

Alphanumeric.

310.010

4

BLANK

310.020 NM Tax on Line 14

PIT-1-

1

Alpha. “R” = Rate table or “B” from PIT-B line 15. REQUIRED

Rate table, PIT-B or

15

Or “Y” = Royalty Income see pit-1 instructions page 2

Royalty income

310.030 Special method

PIT-1-

1

Alpha. Enter 1, 2, 3, 4, or 5 if you owe penalty on underpayment

allowed

29

of estimated tax and you qualify

310.040

6

BLANK

310.050 Itemized deduction

1

Numeric, Enter 1 if itemized deductions else zero

Pit-1

flag

9a

310.060 Name of person

30

Name of person qualifying you as head of household

Pit-1

PIT-1 Line 4, (4) head of household (check Instructions)

4(4)

310.070 Fed Extension

37

Alpha (Reason for Fed Extension i.e. Katrina etc)

Reason

315

Alphanumeric Field 4

80

Alphanumeric

315.010 Fed-item-real-estate

1

Numeric, Enter 1 if itemized deductions else zero

PIT-1

9b

315.015 Midwestern Disaster

10

Alpha (Enter “Midwestern” for additional exemption amount

included for housing individuals displaced by storms, tornadoes,

or flooding)

Refer to instructions for line 10 of PIT-1 form

315.099

69

BLANK

320 – 330 Alphanumeric Fields

240 Alphanumeric. No Entry

5 -7

New Mexico Fed/State Electronic Filing Specifications for 2008

19

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41