Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 30

ADVERTISEMENT

FEDSTATE Unformatted Record Layout

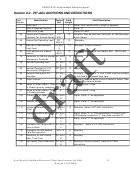

Section 6.5 - PIT-B ALLOCATION / APPORTIONMENT

Field

Identification

Forms

Field

Field Description

Number

Ref.

Length

Byte Count

4

Value ‘nnnn’ where nnnn = length of segment

Start of Record Sentinel

4

Alphanumeric. Value “!!!!”

State Form Name

7

Alpha. Value “PIT-Bbb”

8

60

Primary Residency Period

PIT-B -top

Numeric. Date format MMDDCCYY. If Residency Period

Begin

End [65] is numeric and greater than zero, then this field

must be numeric and greater than zero. This field must

equal zeros for Non-Residents.

65

Primary Residency Period End PIT-B -top

8

Numeric. Date format MMDDCCYY. If Residency Period

Begin [60] is numeric and greater than zero, then this

field must be numeric and greater than zero. This field

must equal zeros for Non-Residents.

67

Spouse residency period from if

PIT-B -top

8

Date MMDDCCYY

different from primary

68

Spouse residency period to if

PIT-B -top

8

Date MMDDCCYY

different from primary

70

Federal Wages, etc.

PIT-B -1

12

Monetary. Exclude nonresident military

col-1

75

NM Wages, etc.

PIT-B -1

12

Monetary. Must not be greater than Federal Wages [70].

col-2

Exclude nonresident military

80

Federal Dividends and Interest

PIT-B -2

12

Monetary.

col-1

85

NM Dividends and Interest

PIT-B -2

12

Monetary.

col-2

90

Federal Pensions, etc.

PIT-B -3

12

Monetary.

col-1

95

NM Pensions, etc.

PIT-B -3

12

Monetary. Must not be greater than Federal Pensions

col-2

[90].

100

Federal Rents and Royalties

PIT-B -4

12

Monetary. May be negative.

col-1

105

NM Rents and Royalties

PIT-B -4

12

Monetary. May be negative.

col-2

110

Federal Gains or Losses

PIT-B -5

12

Monetary. May be negative.

col-1

115

NM Gains or Losses

PIT-B -5

12

Monetary. May be negative.

col-2

New Mexico Fed/State Electronic Filing Specifications for 2008

30

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41