Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 21

ADVERTISEMENT

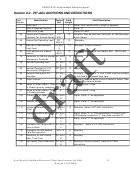

FEDSTATE Generic Record Layout

PIT-1 cont’d

Field

Form

Field

Identification

Field Description

Number

Refs.

Length

415

Total Rebates and

PIT-1-

12

From PIT-RC line 25. [310]; form PIT-RC required

Credits

21 PIT-

RC-25

420

NM Income Tax

PIT-1-

12

Derived by the addition of all “NM” Withholding on

Withheld

22

supporting forms W-2, W-2G, 1099M and 1099R.

425

NM Oil & Gas

PIT-1-

12

NM tax withheld from oil and gas proceeds;

income tax withheld

23

Form 1099 or RPD 41285 required

430

2008 Estimated

PIT-1-

12

See pit-1 instructions

Income Tax

24

Payments

435

Other Payments

PIT-1 -

12

25

440

Total Payments and

PIT-1-

12

add lines 21 thru 25, [415+420+425+430+435]

Credits

26

445

Tax Due

PIT-1-

12

If Net NM Income Tax Amount [410] > Total Payments

27

and Credits [440], enter difference

450

Penalty on

PIT-1-

12

Penalty on underpayment of estimated tax [Leave blank if

underpayment of tax

28

you want penalty computed for you]

455

Penalty

PIT-1 –

12

See pit-1 instructions. [Leave blank if you want penalty

30

computed for you]

460

Interest

PIT-1 –

12

See pit-1 instructions. [Leave blank if you want penalty

31

computed for you]

465

Total tax, penalty

PIT-1 –

12

See pit-1 instructions. [Leave blank if you want penalty

and interest

32

computed for you]

470

Overpayment

PIT-1-

12

If Net NM Income Tax Amount [410] < Total Payments

33

and Credits [440], enter difference.

475

Refund donations

PIT-1-

12

Total Refund Contributions from PIT-D line 10 [90]. May

34

not be greater than Overpayment Amount [450]. Form

PIT-D required

480

Amount to 2009

PIT-1-

12

May not be greater than Overpayment Amount [450]

Estimated Tax

35

485

Amount to be

PIT-1-

12

Line 33 minus lines 34 and 35. [450-455-460].

Refunded

36

490

Not Used

No Entry

THRU

925

Not Used

No Entry

Record Terminus

1

Alphanumeric. Value is "#".

New Mexico Fed/State Electronic Filing Specifications for 2008

21

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41