Personal Income Tax 2008 Sheet - New Mexico Taxation And Revenue Department Page 41

ADVERTISEMENT

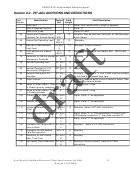

Section 7 – OTHER FORMS

All W-2’s (W-2, W-2C, W-2G) affecting NM income

All 1099’s (1099MISC, 1099R) affecting NM income

W-2, W-2C, W2G

• Include all Federal fields

• Include all State fields i.e.

1099-R, MISC

• Include all federal fields

• Include all State fields i.e.

NOTE: For W-2’s, & 1099’s, the IRS allows foreign address as a valid entry

for the Employer’s address.

•

The Number and the street should be on the address line.

•

The literal (NONE) must be entered in the street address if there is no number

and street.

•

The country must not be abbreviated.

SEE UNFORMATTED RECORDS FOR THE FOLLOWING STATE

FORMS:

• W-K 2008 (NM income and withholding from Pass-Through

Entity)

• RPD-41285 (NM annual statement of withholding of Oil & gas

proceeds)

New Mexico Fed/State Electronic Filing Specifications for 2008

41

Revised 12/10/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41